After the registration under GST, a registered taxpayer can make changes in registration by applying the amendment of registration. Adding an additional place of business is considered a core field amendment. Businesses are exploring and expanding. To accommodate the expansion, some businesses add additional places to their business list. The GST law requires taxpayers to disclose such amendments and additions on the GST portal. Here we are going to tell you about reason for adding additional place of business in GST, how to add additional place in GST or another business in GST (how to add godown address in GST), and how to add branch in GST.

You may open new offices or manufacturing plants as your company grows. You may also need to investigate other marketplaces. To do so, or for other reasons, you may need to include an additional place of business in all legal registrations. GST Registration is one of India’s most popular and significant indirect tax systems

The GST (goods and services tax) is a type of indirect tax. It covers both goods and services. It is an indirect tax that you must collect from customers when selling your goods or services and then remit to the government. If your annual revenue exceeds INR 20 lakh, you must register for GST if you offer products and services across state lines or through an e-commerce platform.

There are four types of GST registration in India. Tax rates range from 0% to 28%, depending on the type of products and services you provide.

What is an additional place of business under GST?

GST registration is geographically dependent. As a result, because GST registration is PAN-based and state-specific, the supplier must register in each state. As a result, a company with multiple locations in different states must register in each state separately.

Furthermore, a company with multiple locations in the same state can designate one as the primary location and the others as secondary locations. In addition, some businesses add new locations to their business list to accommodate growth.

As a result, the GST law requires taxpayers to report such changes and additions to the GST system. In GST Registration, this is referred to as an additional place of business.

Importance of GST Registration

The GST replaced state taxes such as VAT, Luxury Tax, and Purchase Tax (Goods and Service Tax). Several central taxes were also replaced, including customs duty, central excise duty, and service tax.

As a result, it is critical for each taxable entity to register under GST in order to be recognized as a business entity, pay taxes, and enjoy a variety of other benefits.

Failure to register for GST may result in severe penalties, such as a fine equal to 10% of the avoided tax or Rs.10, 000, whichever is greater. If a person fails to register on purpose and is caught as a fraud by authorities, the penalty could be up to 100 percent of the tax amount avoided

Step-by-step guide on how to add an additional place of business on the GST portal

Step 1: Log in to the GST portal

Step 2: Navigate to Service>Registration option and then select the amendment of registration core fields

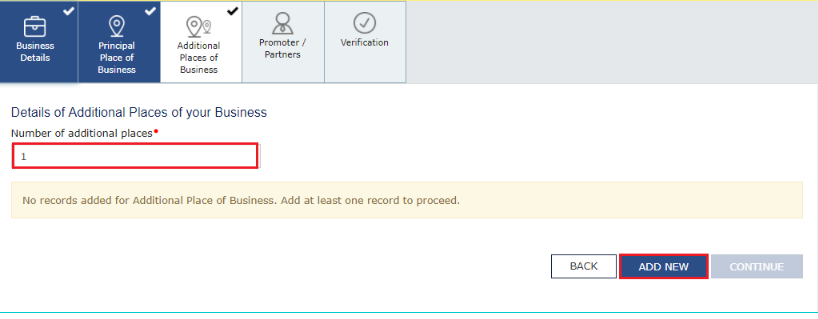

Step 3: Various tabs of editing will be displayed on the screen. A taxpayer should click on the additional place of a business tab.

Step 4: On clicking the additional place of the business tab, the screen below will be displayed.

Click on the ‘Add new’ button and enter the required details. Enter the reason for the amendment and date of the amendment. Then, click on save.

Note: If the business has no additional place of business till now, then one has to go to the tab ‘Principle Place of Business’ and select ‘Yes’ under ‘Have Additional Place of Business’ to add an additional place of business. The registered person can also edit the existing address of ‘Additional Place of Business’.

Step 5: Click on the verification option.

- Select the verification checkbox.

- Select the name of the authorised signatory from the drop-down list.

- Enter the place and select the option for digitally signing the application (Either DSC or EVC).

Step 6: On successful submission of the application, a message will be displayed on the screen stating ‘Successful submission’. An acknowledgement will be sent on the registered email address and mobile number within 15 minutes. The amendment to core fields requires approval by the tax official. Also, a message of application approval or rejection by a tax authority will be sent by SMS and email to the register email ID and mobile number.

FAQs

Q: Can I make changes to the details of the additional place of business after registration?

Yes, you can make changes to the details of the additional place of business by filing an amendment application in Form GST REG-14.

Q: Can I add multiple additional places of business in one registration application?

Yes, you can add multiple additional places of business in one registration application by providing the details of each location in the Form GST REG-01.

Q: Why would I need to add an additional place of business under GST?

If you have business operations at a location other than your registered principal place of business, you are required to declare and register that additional place of business for GST compliance.

Q: What is considered an additional place of business under GST?

An additional place of business is any place where a taxable person carries on business activities and is separate from their principal place of business.

Practice area's of B K Goyal & Co LLP

Income Tax Return Filing | Income Tax Appeal | Income Tax Notice | GST Registration | GST Return Filing | FSSAI Registration | Company Registration | Company Audit | Company Annual Compliance | Income Tax Audit | Nidhi Company Registration| LLP Registration | Accounting in India | NGO Registration | NGO Audit | ESG | BRSR | Private Security Agency | Udyam Registration | Trademark Registration | Copyright Registration | Patent Registration | Import Export Code | Forensic Accounting and Fraud Detection | Section 8 Company | Foreign Company | 80G and 12A Certificate | FCRA Registration |DGGI Cases | Scrutiny Cases | Income Escapement Cases | Search & Seizure | CIT Appeal | ITAT Appeal | Auditors | Internal Audit | Financial Audit | Process Audit | IEC Code | CA Certification | Income Tax Penalty Notice u/s 271(1)(c) | Income Tax Notice u/s 142(1) | Income Tax Notice u/s 144 |Income Tax Notice u/s 148 | Income Tax Demand Notice | Psara License | FCRA Online

Company Registration Services in major cities of India

Company Registration in Jaipur | Company Registration in Delhi | Company Registration in Pune | Company Registration in Hyderabad | Company Registration in Bangalore | Company Registration in Chennai | Company Registration in Kolkata | Company Registration in Mumbai | Company Registration in India | Company Registration in Gurgaon | Company Registration in Noida