The Commissioner of Income-Tax (Appeals) is the first appellate authority and the Income Tax Appellate Tribunal (ITAT) is the second appellate authority. Appeal to the ITAT can be filed by any of the aggrieved party either by the taxpayer or by the Assessing Officer.

The ITAT is constituted by the Central Government and functions under the Ministry of Law. ITAT consists of two classes of members – Judicial and Accountant. In this part you can gain knowledge about various provisions relating to appeals to the ITAT.

Section 5A of the Income Tax Act of 1922 formed the Income Tax Appellate Tribunal (ITAT). The Ministry of Law and Justice operates this body and acts as a subordinate to the High Court of a particular region. ITAT has multiple benches in various states of this country.

Representing the Income Tax Department, Assessing Officers can pass orders through the Commissioner of Income Tax or CIT. However, orders passed by such entities may not be accepted by assessees at times

Appeal to ITAT

Appeal to ITAT includes the following parameters:

- The right to appeal against an order passed by CIT is a legal privilege; it is not an inherent or natural right associated with litigation.

- It cannot be accessed if not clearly stated in the statute.

- No appeal may be filed against any order, directive, or other action if no right of appeal has been granted by any statute concerning such order, direction, or other action. For example, you cannot appeal to ITAT for any orders concerning Section 264. No assessee is expressly granted the right to contest it in court.

ITAT Cause List

he ITAT cause list refers to the list of cases scheduled to be heard by the Income Tax Appellate Tribunal (ITAT) on a particular day. It contains the following details of the case:

- Name of the appellant

- Respondent’s name

- Case number

- The date of filing the appeal

- The nature of the appeal,

- The date on which the case is listed for hearing.

Appealable orders in case of appeal by the Commissioner

If the Principal Commissioner of Income-Tax or Commissioner of Income-Tax objects to the order passed by the Joint Commissioner of the Income-tax (Appeals) or the Commissioner of Income-Tax (Appeals) under section 154 or section 250, then he may direct the Assessing Officer to make an appeal to the ITAT against the orders of the Commissioner of Income-Tax (Appeals). This is Called as departmental appeal, i.e., the Income-Tax department moving to ITAT against the order of the Joint Commissioner of Income-tax (Appeals) or the Commissioner of Income-Tax (Appeals). The departmental appeal shall be allowed only in cases where the tax effect involved in the appeal exceeds Rs. 50,00,000. In other words, the Commissioner of Income-Tax can

direct the Assessing Officer to file an appeal to the ITAT against the order of the Commissioner of Income-Tax (Appeals) only in those cases in which the tax effect [As amended by Finance Act, 2023]exceeds Rs. 50,00,000 [refer Circular No. 17/2019, Dated 08-08-2019].

Time- limit for presenting appeal

Appeal to ITAT is to be filed within a period of 60 days from the date on which order sought to be appealed against is communicated to the taxpayer or to the Principal Commissioner of Income-Tax or Commissioner of Income-Tax (as the case may be).The ITAT may admit an appeal even after the period of 60 days if it is satisfied that there was sufficient cause for not presenting the appeal within the prescribed time.

Form and signature

The appeal to ITAT shall be filed in Form No. 36. In case of appeal by the taxpayer, the form of appeal, the grounds of appeal and the form of verification are to be signed and verified by the person authorised to sign the return of income under section 140. In other words, the Form of appeal is to be signed by the following persons:

1. In case of appeal by the individual taxpayer, by the individual taxpayer himself or by a person duly authorised by him who is holding a valid power of attorney

2. In case of a Hindu Undivided Family by the Karta of the family or if Karta is absent from India or is not capable for signing, by any other adult member of such family.

3. In case of a company by the Managing Director or if Managing Director is not available or where there is no Managing Director by any director of the company.

4. In case of a firm by the Managing Partner or if Managing Partner is not available or where there is no Managing Partner by any partner (not being a minor)

5. In case of a LLP by the Designated Partner or if Designated Partner is not available or where there is no Designated Partner by any partner.

6. In case of a Local Authority by the Principal Officer thereof

7. In case of a Political Party by the Chief Executive Officer of such party

8. In case of any other Association by the Principal Officer thereof or by any member of the Association.

9. In case of any other Person by that Person or by some person competent to act on his behalf.

What is Form 36 of Income Tax Act?

Taxpayers can challenge any order passed by the Commissioner of Income Tax by filing Form 36. However, you get a specified time to appeal against the order with the High Court, generally 60 days. While making the Income Tax appeal, Form 36 must be filled with all the required details. It includes details of the order you are appealing against, relief sought, grounds of appeal, your name, address, and other details.

Form 36 Appeal Fees

As per Section 253 of the Income Tax Act, the fees for filing an appeal to the Tribunal are as follows:

- Rs 500 – when total assessed income is up to Rs 1 Lakh.

- Rs 1500 – when total assessed income is between Rs 1 Lakh and Rs 2 Lakhs.

- Rs 10000 or 1% of assessed income (whichever is less) – when total assessed income is above Rs 2 Lakhs.

- Rs 500 – when the topic of appeal does not concern determined income. This includes, for instance, appeals against orders imposing fines for failure to deduct tax at source or to file specific returns.

- Filing fee is not applicable for cross-objections.

How to File Form 36 Online?

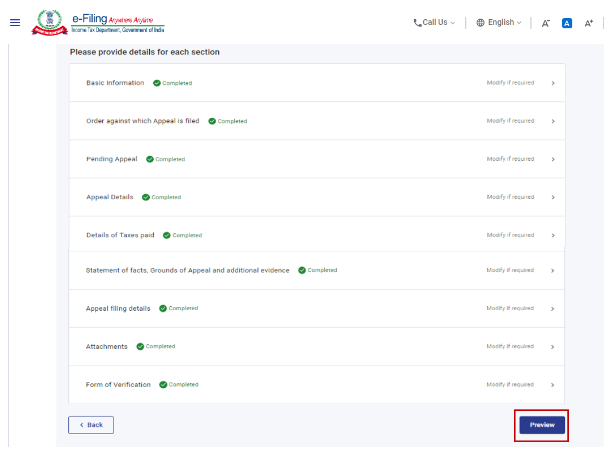

Here are the steps to follow while filing Form 36:

Step 1; Go to the e-filing portal of the Income Tax Department. Log in to your account by entering your User ID (which is your PAN) and password.

Step 2: Once logged in, click the ‘e-File’ tab and select ‘Income Tax Forms’ from the drop-down menu.

Step 3: On the next page, select ‘Form 36’ from the list of forms and click on “Continue”.

Step 4: Fill up the necessary details in this form, such as your name, address, details of taxes paid, grounds of appeal, etc.

Step 5: Upload relevant documents, such as the order passed by the Income Tax Officer, etc.

Step 6: Review your information, and upon validation and verification, click on the “Submit” button.

Step 7: You will receive an acknowledgement on your registered email ID and mobile number.

How to Check ITAT Appeal Status?

Follow these steps to check your ITAT appeal status:

- Visit the official ITAT Judicial Information Portal.

- You will get three options: ‘Search by Appeal Number’, ‘Search by Filling Date’, and ‘Search by Assessee Name’. Select any one of them.

- Select the ‘Bench’ and ‘Appeal Type’ from the drop-down menu.

- Enter the appeal number, filing date, or assessee name as per your selection.

- Drop the captcha code accurately and click on ‘Search’.

FAQs

Q: What is the time limit for an income tax appeal?

The income tax appeal to the Appellate Tribunal should be filed within 60 days of receipt of the order passed by the Commissioner of Income Tax.

Q: Can I file an ITAT appeal online?

Yes, you can file an ITAT appeal online. All you need to do is visit the official e-filing portal of the Income Tax Department and file Form 36. Ensure to provide all information related to the appeal while filling out the form.

Q: How do I file an appeal in the Income Tax Tribunal?

You need to visit the official website of the Income Tax e-filing portal and navigate to Form 36 under the ‘Income Tax Forms’ section. Next, you can fill out the form with the reason for the appeal and proceed accordingly.

Practice area's of B K Goyal & Co LLP

Income Tax Return Filing | Income Tax Appeal | Income Tax Notice | GST Registration | GST Return Filing | FSSAI Registration | Company Registration | Company Audit | Company Annual Compliance | Income Tax Audit | Nidhi Company Registration| LLP Registration | Accounting in India | NGO Registration | NGO Audit | ESG | BRSR | Private Security Agency | Udyam Registration | Trademark Registration | Copyright Registration | Patent Registration | Import Export Code | Forensic Accounting and Fraud Detection | Section 8 Company | Foreign Company | 80G and 12A Certificate | FCRA Registration |DGGI Cases | Scrutiny Cases | Income Escapement Cases | Search & Seizure | CIT Appeal | ITAT Appeal | Auditors | Internal Audit | Financial Audit | Process Audit | IEC Code | CA Certification | Income Tax Penalty Notice u/s 271(1)(c) | Income Tax Notice u/s 142(1) | Income Tax Notice u/s 144 |Income Tax Notice u/s 148 | Income Tax Demand Notice

Company Registration Services in major cities of India

Company Registration in Jaipur | Company Registration in Delhi | Company Registration in Pune | Company Registration in Hyderabad | Company Registration in Bangalore | Company Registration in Chennai | Company Registration in Kolkata | Company Registration in Mumbai | Company Registration in India | Company Registration in Gurgaon