GST registration details play a pivotal role in verifying the legitimacy of businesses and ensuring adherence to GST laws. By utilizing the search and verification feature on the GST Portal via GSTIN, individuals can promptly access comprehensive information about registered taxpayers, including legal names, state jurisdictions, GSTIN status, and additional business particulars.

GST Registration is an obligatory process for businesses operating in India that must adhere to the Goods and Services Tax (GST) framework. It encompasses acquiring a unique identification number known as GSTIN (Goods and Services Tax Identification Number).

GST registration is indispensable for businesses with an annual turnover surpassing the government’s prescribed threshold. By acquiring GST registration, businesses become eligible to collect and remit GST, claim input tax credits, and partake in inter-state trade. This process is vital in ensuring compliance with GST regulations and becoming an integral part of the formal economy.

What is GSTIN?

GSTIN is the GST identification number or GST number. A GSTIN is a 15-digit PAN-based unique identification number allotted to every registered person under GST. As a GST-registered dealer, you might want to do a GST verification before entering it into your GST Returns. You can use the GST number check tool to do GST number (GSTIN) verification.

There can be multiple GSTINs for a single person with a PAN, being an assessee under the Income Tax Act. A GSTIN is obtained for every state or Union Territory from which such a person operates. It becomes compulsory to obtain GSTIN when the person crosses the threshold limit for GST registration by registering himself under GST.

Unlike the previous indirect tax regime where multiple registration numbers were present for different laws such as Excise, Service Tax and VAT, GSTIN is a single registration number under GST.

Why is it necessary to verify the GST Number?

A GSTIN or GST number is public information. GST search by name is an important task that every business dealing with GST-registered taxpayers must carry out to ensure the authenticity of the vendor and the GSTIN or GST number being used in the invoice.

You can partly verify the GSTIN or GST number on the first look by checking if the vendor’s PAN number matches with the digits between 3 and 10 in the GSTIN.

It is also necessary to carry out a thorough check of the GSTIN authenticity to avoid generating incorrect invoices and e-invoices, to claim a genuine input tax credit, and to pass on the tax credits to rightful buyers, to mention a few.

Why is it necessary to verify the GST Number?

A GSTIN or GST number is public information. GST search by name is an important task that every business dealing with GST-registered taxpayers must carry out to ensure the authenticity of the vendor and the GSTIN or GST number being used in the invoice.

You can partly verify the GSTIN or GST number on the first look by checking if the vendor’s PAN number matches with the digits between 3 and 10 in the GSTIN.

It is also necessary to carry out a thorough check of the GSTIN authenticity to avoid generating incorrect invoices and e-invoices, to claim a genuine input tax credit, and to pass on the tax credits to rightful buyers.

Exploring GSTIN – Simplified Search and Verification on the GST Portal

GSTIN (Goods and Services Tax Identification Number) is a distinctive 15-digit identification code issued to businesses registered under GST. It assumes a crucial role in recognizing and validating registered taxpayers. The composition of the GSTIN is derived from the business’s PAN number, making it a fundamental component within the GST ecosystem.

Efficient Verification of Taxpayer Details using GSTIN on the GST Portal

The Goods and Services Tax (GST) has brought about a transformative change in India’s taxation system, with the GST Portal as a pivotal facilitator for various GST-related activities. A noteworthy feature of the GST Portal is the “Search Taxpayer GST” function, enabling users to access the profile of any registered taxpayer by inputting their GSTIN. This functionality allows businesses and individuals to verify the accuracy and authenticity of GSTINs cited on various documents.

By utilizing the “GST Search Taxpayer” option on the GST Portal, users can readily validate the particulars of registered dealers or suppliers and ensure their alignment with GST regulations. This feature empowers businesses to make well-informed decisions when transacting with other taxpayers. Whether accessed before or after logging in, the user-friendly interface simplifies the search process, making it effortless for individuals to retrieve vital information from the GST Portal.

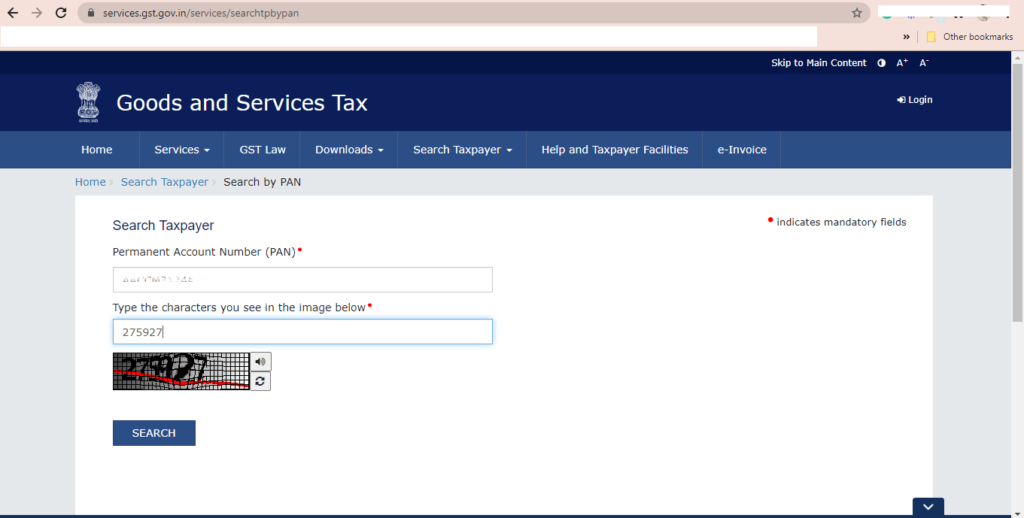

Accessing Taxpayer Details Before Logging In:- Before initiating a login, you can access specific taxpayer details using the GSTIN/UIN. The following steps elucidate the process:

- Visit the official GST Portal website and select the “Search Taxpayer” menu on the homepage.

- Enter the GSTIN/UIN of the desired taxpayer.

- Upon clicking the SEARCH button, the subsequent details will be presented:

- GSTIN/UIN

- Legal Name of Business

- State Jurisdiction

- Centre Jurisdiction

- Date of Registration

- Business Constitution

- Taxpayer Type

- GSTIN/UIN Status

- Date of Cancellation

- A field Visit Conducted

- Nature of Business Activity

- Return Filing Status

Accessing Additional Details After Logging In:- Upon successful login to the GST Portal using valid credentials, you gain access to additional taxpayer details, encompassing:

- Name of the Proprietor/Director(s)/Promoter(s)

- Supplementary Place of Business

- Contact Information of Principal Place of Business

Furthermore, you can also view the Return Status for the ten most recent transactions.

Searching for Details of Different Taxpayers:- The process of searching for details of various taxpayers varies depending on their category:

- For normal taxpayers: To retrieve details of a regular taxpayer, input the respective GSTIN.

- For UN Bodies, Embassies, Government Offices, or Other Notified Entities: To obtain details of these taxpayer categories, furnish the Unique Identification Number (UIN).

The “GST Search Taxpayer” feature on the GST Portal empowers businesses and individuals to access conveniently and verify the details of registered dealers or suppliers through their GSTIN/UIN. Whether you seek to verify your particulars or those of other taxpayers, the GST Portal presents a user-friendly interface that grants easy access to vital information.

GST Number Search:- GST number Search is essential to validate the legitimacy of a business and ensure its compliance with GST rules. By performing a GST number lookup and validation, you can quickly access vital information about registered taxpayers, including their legal names, business locations, GSTIN status, and other pertinent data.

Advantages of online GSTIN search & verification tool or GSTIN Validator

The benefits of GST number verification using the online GST Search tool are:

- Checks the authenticity of any GSTIN

- A GSTIN on a hand-written invoice can be verified easily, if unclear

- You can prevent yourself from associating with vendors using fake GSTINs

- Avoid a GSTIN fraud at the origin of the transaction

- Help vendors correct any potential error in reporting GSTINs

FAQs

Q: When will a GSTIN be allocated?

Once the GST registration application is processed successfully, the GST portal will allocate a 15-digit GSTIN to the applicant.

Q: Is it mandatory to mention GSTIN on the invoices?

Yes, it is mandatory to mention GSTIN on all the invoices raised by a taxpayer. Also, the GST-registered person should display the GST registration certificate at all places of business.

Q: What are the uses of GSTIN?

GSTIN is one of the prerequisites for starting a business. As per the GST law, GSTIN has to be displayed at all places of businesses of a registered individual. Also, it has to be quoted during the process of raising invoices, while generating e-way bills, during GST return filing, and during the submission of information to the tax department.

Q: Can we find the owner's name by GST number? / How to find the name from GST number

You can type in the GST number or GSTIN in the search tool as input. As a result, you will be displayed with the owner’s name – Trade name and Legal name.

Practice area's of B K Goyal & Co LLP

Income Tax Return Filing | Income Tax Appeal | Income Tax Notice | GST Registration | GST Return Filing | FSSAI Registration | Company Registration | Company Audit | Company Annual Compliance | Income Tax Audit | Nidhi Company Registration| LLP Registration | Accounting in India | NGO Registration | NGO Audit | ESG | BRSR | Private Security Agency | Udyam Registration | Trademark Registration | Copyright Registration | Patent Registration | Import Export Code | Forensic Accounting and Fraud Detection | Section 8 Company | Foreign Company | 80G and 12A Certificate | FCRA Registration |DGGI Cases | Scrutiny Cases | Income Escapement Cases | Search & Seizure | CIT Appeal | ITAT Appeal | Auditors | Internal Audit | Financial Audit | Process Audit | IEC Code | CA Certification | Income Tax Penalty Notice u/s 271(1)(c) | Income Tax Notice u/s 142(1) | Income Tax Notice u/s 144 |Income Tax Notice u/s 148 | Income Tax Demand Notice | Psara License | FCRA Online

Company Registration Services in major cities of India

Company Registration in Jaipur | Company Registration in Delhi | Company Registration in Pune | Company Registration in Hyderabad | Company Registration in Bangalore | Company Registration in Chennai | Company Registration in Kolkata | Company Registration in Mumbai | Company Registration in India | Company Registration in Gurgaon | Company Registration in Noida