The share capital of a company must be classified into different types while being presented in the financial statements. In this article, we look at the different types of share capital and the mode for presentation of share capital on the financial statements.

For companies, funding is the most vital part for functioning of the business and Share capital is the main funding for companies. Share Capital is the whole amount of money that a company increases from the sale of its shares to investors. It shows the long-term financing of the company, and is used to fund its investments, operations, and growth. Share Capital is a significant source of funding for companies and is increased by issuing shares to its stakeholders. There are mainly two kinds of share capital that we will discuss in this below article.

What is Share Capital?

Share Capital means to the total amount of capital raised by a company through the issuance of shares to its shareholders. It refers that the amount of money, the company has received from its shareholders in exchange for a certain no. of shares. It is a significant element of a company’s balance sheet and is recorded as a liability on the company’s books. It helps the company to finance their expansion plans and development.The Share capital definition refers to the funds raised by an entity to issue shares to the general public. Simply put, share capital is the money contributed to a firm by its shareholders. It is a long-term capital source and facilitates smooth operations, profitability, and financial growth.

Primarily, capital represents the assets used to carry on a business. Alternatively, it may be the resources required to launch a venture. The terms capital and share capital are interchangeable. In the Indian Companies Act, share capital refers to a company’s percentage of capital or interest.

The Company’s Memorandum of Association mentions the maximum amount of share capital. The company may increase the maximum share capital with an amendment to its Memorandum of Association. Moreover, a company limited by stock issues share capital, whereas a company limited by guarantee does not have any capital.

From a financial reporting standpoint, share capital appears under liabilities in a balance sheet. In the case of liquidation, the shareholders receive the residual assets after payment of all other liabilities.

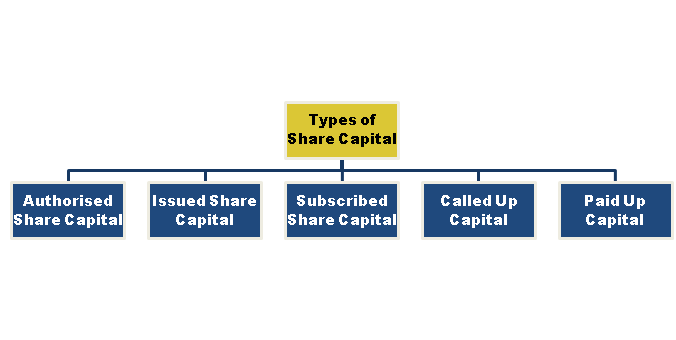

What are the Types of Share Capital?

Share capital is the capital raised by a company through the issue of shares to the shareholders. In simple terms, it is the money invested by the shareholders in the company. The Companies Act, 2013 in India lays down the rules and regulations for the issuance and management of share capital by companies. There are different types of share capital as per the Companies Act, 2013. These are:

- Authorized Share Capital: Authorized Share Capital is the entire capital that a company takes from its investors by issuing shares that are listed in the company’s official documents. It is also known as Registered Capital or Nominal Capital since it is used to register a company.

The maximum of Authorised Capital is specified in the Memorandum of Association, according to Section 2(8) of the Companies Act, 2013. The company has the option to take the appropriate actions to expand the limit of authorised capital in order to issue more shares, but it is not permitted to issue shares that exceed the limit of authorised capital in any situation.

- Issued Share Capital: The portion of Authorized Share Capital that has been issued to the public for subscription is known as Issued Share Capital. This act of issuing shares is referred to as issuance, allocation, or allotment. To put it simply, Issued Share Capital is the subset of Authorized Share Capital. A subscriber becomes a shareholder after receiving shares.

- Subscribed Capital: Subscribed Capital is the portion of issued Capital that has been sold to the public. The public is not required to completely subscribe to the issued Capital. It is the portion of the issued capital for which the company has received an application. Let me illustrate this using an example: If a corporation sells 16000 Rs. 100 shares and the public only applies for 12000 shares, the issued capital is Rs 16 lakh and the subscribed capital is Rs 12 lakh. The total number of issued shares equals the entire number of outstanding shares plus treasury shares.

- Called-Up Capital: Called-Up Capital is a portion of the Subscribed Capital that includes the shareholder’s payment. The complete amount of Capital is not given to the company at once. It draws on a portion of the subscribed Capital as needed in installments. Uncalled Capital is the remainder of the Subscribed Capital.

- Paid-Up Capital: Paid-up Capital refers to the portion of Called-up Capital paid by the shareholder. The shareholder is not required to pay the amount requested by the company in question. The shareholder may pay half of the called-up capital, which is referred to as Reserved Capital. As the term implies, reserving funds in the company’s treasury. This is very important if the company is going to discontinue or winds up.

The Companies Amendment Act, 2015 altered the need for a minimum paid-up capital in the company. That means that, for the time being, a company can be formed with as little as Rs.1000 in paid-up capital. The paid-up capital must always be less than or equal to the approved share capital at all times, and the business is not permitted to issue shares in excess of the authorised share capital.

- Equity Share Capital: It shows the ownership in a company and grants the shareholder to receive a share of the profits if company is sold or liquidated, receive dividends, and vote on company’s decisions. Equity shareholders have a residual claim on the assets and earnings of the company, meaning they are last in line to receive payment after all other claims are satisfied.

Types of Equity Share Capital

Some of the different types of equity share capital are:

- Ordinary Shares: These are the most common type of equity share capital issued by companies. It represents ownership in the company and entitles the shareholder to vote on company’s decisions.

- Deferred Shares: These are carrying a lower entitlement to dividends and/or voting rights as compared to ordinary shares. They are often used to differentiate between shareholders who have been with the company for a longer period of time or those who have invested a larger amount of money.

- Founders Shares: These are issued to the founder of a company. They often carry special voting rights or dividends entitlements to provide the founders huge control over the company.

- Management Shares: These are issued to the company’s management team, permitting them to own a portion of the company that they are operating. It is often come with certain restrictions like to make sure management acts, limited voting rights in the best interests of the Company.

- Preference Share Capital

Preference share capital is a type of share capital that entitles the shareholder to preferential treatment over equity shareholders in terms of receiving dividends or receiving the proceeds from the sale or liquidation of the company. Preference shareholders have a fixed rate of return and are entitled to receive their dividends before equity shareholders. Preference shares do not usually carry voting rights and are therefore less influential in the management of the company.

Types of Preference Share Capitals

There are certain types of Preference Share capitals are as:-

- Cumulative Preference Shares: Cumulative preference shares are a type of preference share capital that entitles the shareholder to receive unpaid dividends from previous years before any dividends are paid to equity shareholders.

- Redeemable Preference Shares: Redeemable preference shares are a type of preference share capital that can be redeemed by the company after a specific period or at a specific date. They are often used as a short-term financing option.

- Participating Preference Shares: Participating preference shares are a type of preference share capital that entitles the shareholder to receive a share of the profits in addition to their fixed dividend payment. They are also entitled to receive their fixed dividend payment before equity shareholders.

- Non-Cumulative Preference Shares: Non-cumulative preference shares are a type of preference share capital that does not entitle the shareholder to receive unpaid dividends from previous years. If a company does not declare a dividend in a particular year, the shareholder does not receive any payment for that year.

- Sweat Equity Shares: Sweat equity shares are shares issued to employees or directors of the company as a reward for their contribution to the company’s growth. Sweat equity shares can be issued at a discount or for consideration other than cash.

- Rights Issue: A rights issue is an offer of shares to the existing shareholders of the company in proportion to their existing shareholding. The purpose of a rights issue is to raise capital without diluting the ownership of the existing shareholders.

- Bonus Issue: A bonus issue is an issue of free shares to the existing shareholders of the company in proportion to their existing shareholding. The purpose of a bonus issue is to reward the existing shareholders for their investment in the company.

- Employee Stock Option Plan (ESOP): An employee stock option plan (ESOP) is a scheme where the company offers its employees the option to purchase shares of the company at a discounted price. The purpose of an ESOP is to motivate and retain employees by providing them with a stake in the company’s growth.

Merits of issuing the Share Capital

- Long-term Funding: Share capital provides a long-term source of funding for a company as shareholders are typically invested in the company for the long term.

- No Interest Payments: Unlike debt financing, there are no interest payments associated with share capital. This means that the company can save money on interest payments and have more funds available for other purposes.

- Limited Liability: Shareholders have limited liability, which means that they are not personally liable for the company’s debts and obligations. This reduces the risk for shareholders and can make the company more attractive to investors.

- Improved Credit Rating: Issuing share capital can improve a company’s credit rating as it shows that the company has a diverse range of funding sources.

- Increased Public Profile: Issuing shares can increase a company’s public profile and provide exposure to potential investors.

- Flexibility: Issuing shares provides a company with flexibility in terms of how it uses the funds raised. The company can choose to invest in new projects, pay off debt, or use the funds for other purposes.

Demerits of issuing the Share Capital

- Dilution of Ownership: Issuing new shares can dilute the ownership of existing shareholders, which can lead to a loss of control over the company.

- Dividend Payments: Issuing shares creates an obligation for the company to pay dividends to shareholders, which can reduce the company’s profits and limit its ability to reinvest in the business.

- Cost of Issuing Shares: Issuing shares can be costly, as the company may need to pay fees to investment bankers, lawyers, and accountants. Additionally, the company may need to pay dividends or other incentives to attract investors.

- Increased Scrutiny: Issuing shares can increase the level of scrutiny on the company, as shareholders and regulatory authorities may closely monitor the company’s activities and financial performance.

- Share Price Volatility: The price of a company’s shares can be volatile and subject to fluctuations due to changes in market conditions, investor sentiment, and other factors. This can create uncertainty for shareholders and make it more difficult for the company to raise capital in the future.

- Regulatory Compliance: Companies that issue shares are subject to various regulations and requirements, which can be complex and time-consuming to navigate.

Why do Companies Issue Share Capital?

- Raising Funds: One of the primary reasons why companies issue share capital is to raise funds. By issuing shares, companies can raise money from investors without incurring debt or interest expenses. This capital can be used to fund their operations, invest in new projects, or expand their business.

- Diluting Risk: When a company has a large number of shareholders, it can dilute the risk associated with ownership. This means that if the company faces losses, the losses are spread out among a larger group of people, reducing the risk for each shareholder.

- Rewarding Shareholders: Companies may issue shares to reward their existing shareholders by giving them the opportunity to increase their ownership stake in the company. This can also help to build shareholder loyalty and support.

- Building Reputation: Companies that issue shares publicly are often viewed as more reputable and trustworthy compared to private companies. This is because they are subject to greater scrutiny and regulation, which can improve investor confidence and help to attract more investors.

- Avoiding Debt: Companies that do not want to take on debt may choose to issue shares instead. This can be beneficial as the company is not required to make fixed payments to shareholders and the capital raised does not need to be repaid.

FAQs

Q: How are dividends paid to shareholders?

Dividends are typically paid on a per-share basis. Equity shareholders receive dividends based on the profits of the company, while preference shareholders receive fixed dividends.

Q: What are equity shares?

Equity shares, also known as ordinary shares, represent ownership in a company. Shareholders have voting rights and may receive dividends, but these dividends are not fixed.

Q: What are the types of share capital?

There are two main types:

a. Equity Share Capital: Represents ownership in the company and gives shareholders voting rights.

b. Preference Share Capital: Carries a fixed dividend rate and has priority over equity shares in terms of dividends and assets during liquidation.

Practice area's of B K Goyal & Co LLP

Income Tax Return Filing | Income Tax Appeal | Income Tax Notice | GST Registration | GST Return Filing | FSSAI Registration | Company Registration | Company Audit | Company Annual Compliance | Income Tax Audit | Nidhi Company Registration| LLP Registration | Accounting in India | NGO Registration | NGO Audit | ESG | BRSR | Private Security Agency | Udyam Registration | Trademark Registration | Copyright Registration | Patent Registration | Import Export Code | Forensic Accounting and Fraud Detection | Section 8 Company | Foreign Company | 80G and 12A Certificate | FCRA Registration |DGGI Cases | Scrutiny Cases | Income Escapement Cases | Search & Seizure | CIT Appeal | ITAT Appeal | Auditors | Internal Audit | Financial Audit | Process Audit | IEC Code | CA Certification | Income Tax Penalty Notice u/s 271(1)(c) | Income Tax Notice u/s 142(1) | Income Tax Notice u/s 144 |Income Tax Notice u/s 148 | Income Tax Demand Notice | Psara License | FCRA Online

Company Registration Services in major cities of India

Company Registration in Jaipur | Company Registration in Delhi | Company Registration in Pune | Company Registration in Hyderabad | Company Registration in Bangalore | Company Registration in Chennai | Company Registration in Kolkata | Company Registration in Mumbai | Company Registration in India | Company Registration in Gurgaon | Company Registration in Noida