GST Registration is the process by which a business becomes registered under India’s Goods and Services Tax (GST) system. Once registered, the business is legally recognized as a supplier of goods or services and must collect GST on sales and remit it to the government. This registration is essential for businesses whose turnover exceeds a specific threshold. To obtain GST registration, the applicant must apply to the GST authorities. Upon successful registration, the business is assigned a unique identification number, known as the GSTIN (Goods and Services Tax Identification Number), which is crucial for all GST-related transactions and compliance activities.

What is ARN?

The Application Reference Number (ARN) is a 15-digit code assigned to your GST registration application. It serves as an identifier for tracking the progress of your application and is crucial for the GST status check process.

Once you submit your GST registration application, the GST portal automatically generates the ARN. This number allows you to monitor the status of your application at various stages, from submission to approval / rejection. The ARN facilitates coordination between you and the GST authorities. Hence, the GST ARN tracking process should be taken seriously.

What are the Various Types of GST ARN Statuses?

1. Pending for Processing- This status indicates that your GST registration application has been successfully submitted and is awaiting processing by the GST authorities.

2. Under Verification- Your application is under review at this stage, and the GST authorities are verifying the information provided. This phase involves an examination of all submitted documents and details.

3. Approved- When the GST authorities confirm the accuracy of the details and their compliance with GST regulations, the application status changes to “Approved.”

4. Rejected- The application could be rejected if the authorities find discrepancies, incomplete details or violations of GST rules. Reasons for rejection will be provided so you can address any issues and reapply if needed.

5. Cancelled- In some GST registration cancellation cases, approved applications may be cancelled later due to non-compliance or violations of GST regulations.

6. Pending for Clarification- When the authorities need additional information or clarification, the application status will show as “Pending for Clarification.” You must provide the required details for further processing.

7. Provisional- Under some circumstances, provisional registration may be granted by the authorities to allow you to start business activities while verification is ongoing.

8. Migrated- Businesses registered under tax systems (such as VAT and Service Tax) will have their status changed to “Migrated” when transitioning to the GST regime. Their registration has been smoothly transitioned to the GST platform, confirming its migration.

Decoding the GST ARN

The ARN is a unique alphanumeric code, typically 15 characters long, incorporating both letters and numbers. The composition of this number is thoughtfully structured: it starts with two alphabetical characters, followed by the Indian state code represented in two numerical digits. Subsequently, four characters signify the month and year of registration. The sequence culminates in a six-digit number, the last digit of which serves as a checksum.

A typical ARN, for example, will have the following format: AA 01 04 30 000000 1

ARN Number Generation Process

- Submission of GST Registration Application: An applicant begins by submitting their GST registration application through the GST Portal. This is typically done by filling out the necessary details and uploading the documents on the portal.

- Completion of Application: Once the application is completed and all mandatory fields are filled, the applicant submits it online.

- Automatic Generation of ARN: Upon successful submission of the GST registration application, the GST Portal automatically generates an Application Reference Number (ARN).

- Receipt of ARN: The ARN is then communicated to the applicant, usually via email, or it can be noted directly from the GST Portal immediately after submission.

- Use of ARN for Tracking: This ARN number is crucial as it allows the applicant to track the status of their GST registration application on the GST Portal until the final GSTIN (Goods and Services Tax Identification Number) and GST Certificate are issued by the government.

How to Check GST Registration Status for First-Time Applicants?

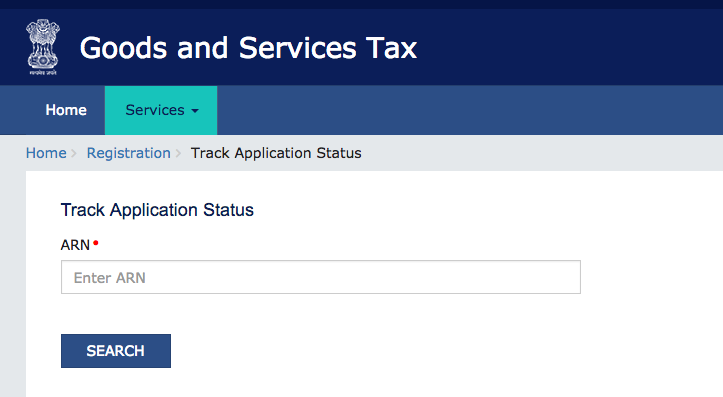

STEP 1: Go to the website > Click the ‘Services’ > ‘Track Application Status’ option.

STEP 2: Select the ‘Registration’ option from the drop-down list.

STEP 3: The Registration Module will open and prompts you to enter the ARN or SRN. Once entered, click on ‘Search’.

STEP 4: The screen will display a detailed report titled ‘Detailed Status: Show Case History of New Registration Application’. This screen provides information about the stage at which your registration application is pending. There are seven stages through which your application for GST registration has to pass through. Each completed stage is highlighted in green and the pending stages are highlighted in grey.

ARN Number Considered So Important?

- Proof of Application Submission: The ARN number is generated immediately after submitting a GST registration application, proving that the application has been successfully submitted to the GST portal.

- Tracking Application Status: It enables businesses and individuals to track the real-time status of their GST registration application. This feature is useful to keep abreast of the application’s progress and required actions.

- Interim Business Identifier: Until the GSTIN (Goods and Services Tax Identification Number) is issued, the ARN number acts as an interim identifier for business transactions. This is crucial for businesses to continue their operations without hindrance during the registration process.

- Facilitating Communication with Tax Authorities: The ARN number is a key reference in communications with tax authorities regarding the GST registration. It helps in the efficient and quick resolution of queries or issues.

- Validation of Application Details: The ARN references the details submitted in the GST registration application, ensuring that the information is processed and validated correctly by the tax authorities.

- Essential for Further GST Procedures: For any subsequent modifications, updates, or inquiries about GST registration, the ARN number is often required. It is integral to the continuation of various GST-related procedures.

FAQs

Who can apply for an ARN?

Any individual, business or organisation that needs to register for GST can apply for an ARN. This includes sole proprietorships, partnerships, companies and other legal entities supplying goods or services.

How do I find a company’s GST number by name?

You can find a company’s GST number by name on the GST portal. Visit the ‘Search Taxpayer’ section, enter the company’s name or other relevant details, and the search results will display the GST number if the company is registered under GST.

How do I check my GST application status via TRN?

To check GST status application using the TRN, visit the GST Portal, navigate to the ‘Registration’ section, and select the ‘Track Application Status’ option. Enter your TRN to view the current status of your application.

Practice area's of B K Goyal & Co LLP

Income Tax Return Filing | Income Tax Appeal | Income Tax Notice | GST Registration | GST Return Filing | FSSAI Registration | Company Registration | Company Audit | Company Annual Compliance | Income Tax Audit | Nidhi Company Registration| LLP Registration | Accounting in India | NGO Registration | NGO Audit | ESG | BRSR | Private Security Agency | Udyam Registration | Trademark Registration | Copyright Registration | Patent Registration | Import Export Code | Forensic Accounting and Fraud Detection | Section 8 Company | Foreign Company | 80G and 12A Certificate | FCRA Registration |DGGI Cases | Scrutiny Cases | Income Escapement Cases | Search & Seizure | CIT Appeal | ITAT Appeal | Auditors | Internal Audit | Financial Audit | Process Audit | IEC Code | CA Certification | Income Tax Penalty Notice u/s 271(1)(c) | Income Tax Notice u/s 142(1) | Income Tax Notice u/s 144 |Income Tax Notice u/s 148 | Income Tax Demand Notice | Psara License | FCRA Online

Company Registration Services in major cities of India

Company Registration in Jaipur | Company Registration in Delhi | Company Registration in Pune | Company Registration in Hyderabad | Company Registration in Bangalore | Company Registration in Chennai | Company Registration in Kolkata | Company Registration in Mumbai | Company Registration in India | Company Registration in Gurgaon | Company Registration in Noida | Company Registration in lucknow

Complete CA Services

RERA Services

Most read resources

tnreginet |rajssp | jharsewa | picme | pmkisan | webland | bonafide certificate | rent agreement format | tax audit applicability | 7/12 online maharasthra | kerala psc registration | antyodaya saral portal | appointment letter format | 115bac | section 41 of income tax act | GST Search Taxpayer | 194h | section 185 of companies act 2013 | caro 2020 | Challan 280 | itr intimation password | internal audit applicability | preliminiary expenses | mAadhar | e shram card | 194r | ec tamilnadu | 194a of income tax act | 80ddb | aaple sarkar portal | epf activation | scrap business | brsr | section 135 of companies act 2013 | depreciation on computer | section 186 of companies act 2013 | 80ttb | section 115bab | section 115ba | section 148 of income tax act | 80dd | 44ae of Income tax act | west bengal land registration | 194o of income tax act | 270a of income tax act | 80ccc | traces portal | 92e of income tax act | 142(1) of Income Tax Act | 80c of Income Tax Act | Directorate general of GST Intelligence | form 16 | section 164 of companies act | section 194a | section 138 of companies act 2013 | section 133 of companies act 2013 | rtps | patta chitta