CA Bhuvnesh Goyal

CA Bhuvnesh Goyal is a qualified Chartered Accountant with a strong command over taxation, finance, compliance, and business advisory. With years of experience serving startups, SMEs, and corporate clients, he brings practical solutions and deep financial insight to the table.

Bhuvnesh is passionate about simplifying financial and regulatory concepts for a wider audience. His articles aim to bridge the gap between technical tax laws and everyday business needs, helping entrepreneurs and professionals stay informed and confident in their decisions.

Whether it’s decoding GST updates, income tax provisions, or financial planning tips, Bhuvnesh’s content is focused on clarity, accuracy, and real-world applicability.

Updates from CA Bhuvnesh Goyal

In 2012, the Securities and Exchange Board of India (SEBI) introduced a framework for ESG (Environmental, Social, and Governance) reporting in India. This was initially done through the Business...

Non-financial reporting has gained global significance as businesses recognize their impact on the environment, society, and governance (ESG). This shift has encouraged companies to adopt more...

The understanding of NGBRC is relevant to appreciating the BRSR reporting framework. The National Guidelines for Responsible Business Conduct (NGRBC) were introduced to help businesses go beyond...

What is Sustainability Reporting? Sustainability reporting provides an overview of a company’s economic, environmental, and social impacts caused by its daily activities. It is not just about...

The Indian government has introduced Section 285BAA in the Income-tax Act, making it mandatory for reporting entities to disclose details of crypto transactions. This section will come into effect...

What is ITR U? ITR U is a form introduced by the Income Tax Department of India that allows taxpayers to file an Updated Return. If you made a mistake in your original tax return or forgot to report...

The Indian government has introduced Section 44BBD in the Income-tax Act, which will take effect from April 1, 2026. This section provides special provisions for computing profits and gains of...

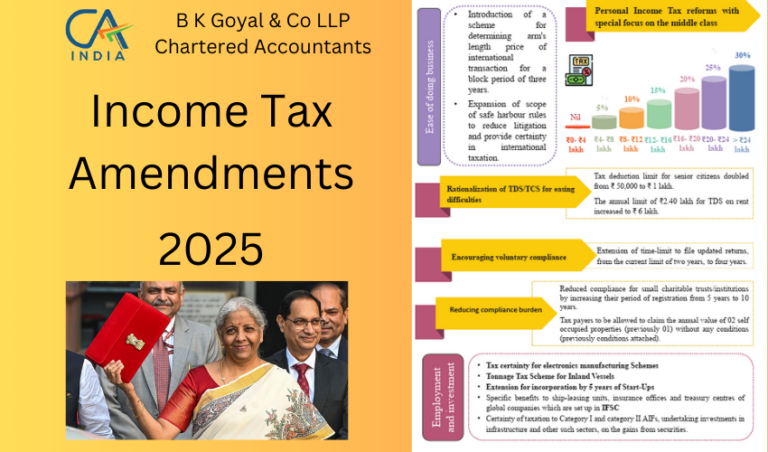

The Finance Bill, 2025 has introduced several amendments to the Income-tax Act, 1961 that will impact taxpayers for Assessment Year (AY) 2026-27 and AY 2025-26. These changes aim to simplify tax...

https://www.youtube.com/watch?v=Ma5tfXdVQoQ Dhan dhanya krishi yojana: enhance agriculture productivity, improve irrigation facility. Help 1.7 crore farmers Atma-nirbharta in pulses Makhana board in...