What Happens If Pan Card Is Not Linked To Aadhaar Card

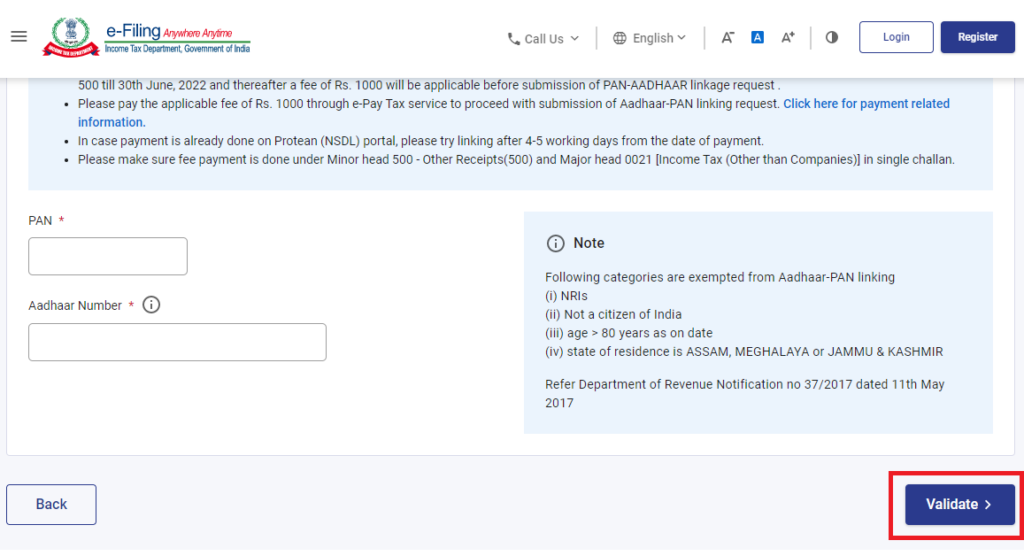

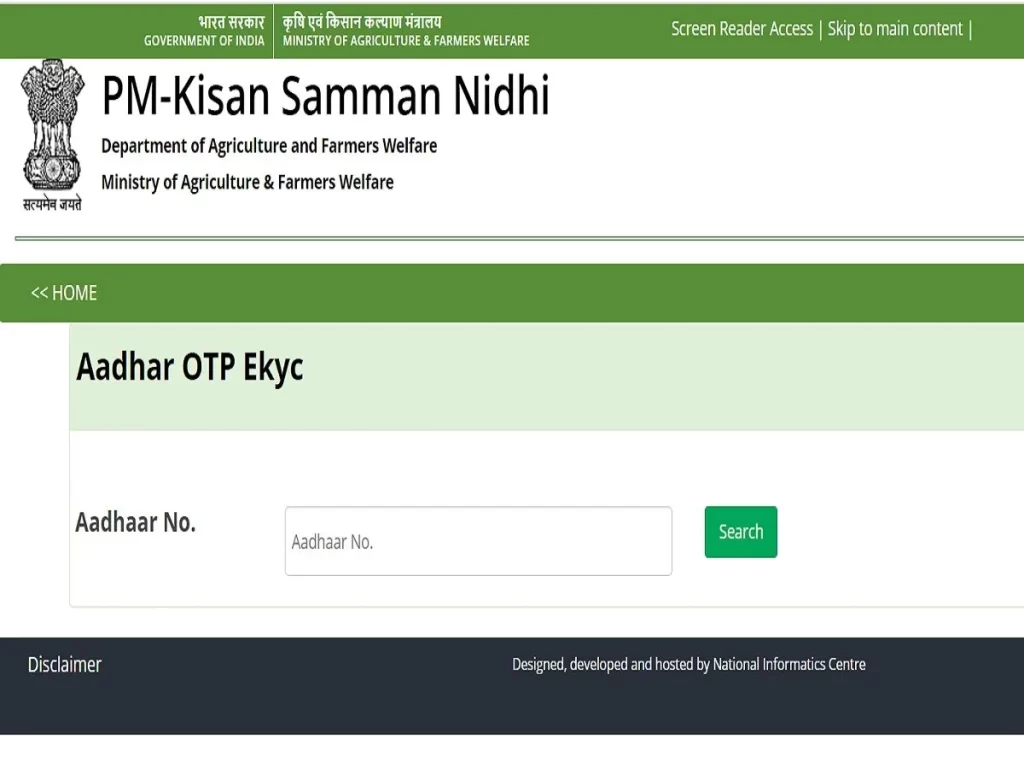

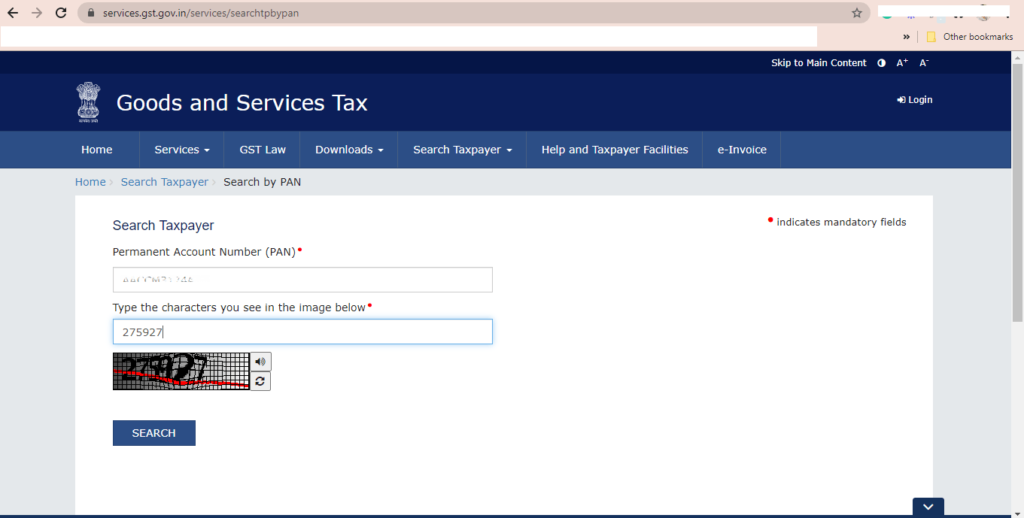

PAN unlinked with Aadhaar could get deactivated. This will result in higher taxation, penalties, and problems for the persons in financial transactions. The article presents advantages to the government and people through this linking exercise, sets out a step-by-step procedure for linking Aadhaar with PAN before the deadline of June 30, 2023, What is the […]