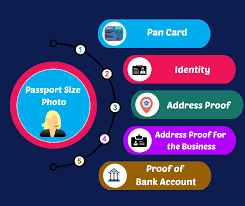

Documents Required for GST Registration

GST registration number or GST identification Number (GSTIN) is a unique 15-digit number provided by the tax authorities to monitor tax payments and compliances of the registered person. Business needs different sets of documents depending upon the constitution of the business or the type of GST registration that they wish to obtain. Any person making the […]