CA Bhuvnesh Goyal

CA Bhuvnesh Goyal is a qualified Chartered Accountant with a strong command over taxation, finance, compliance, and business advisory. With years of experience serving startups, SMEs, and corporate clients, he brings practical solutions and deep financial insight to the table.

Bhuvnesh is passionate about simplifying financial and regulatory concepts for a wider audience. His articles aim to bridge the gap between technical tax laws and everyday business needs, helping entrepreneurs and professionals stay informed and confident in their decisions.

Whether it’s decoding GST updates, income tax provisions, or financial planning tips, Bhuvnesh’s content is focused on clarity, accuracy, and real-world applicability.

Updates from CA Bhuvnesh Goyal

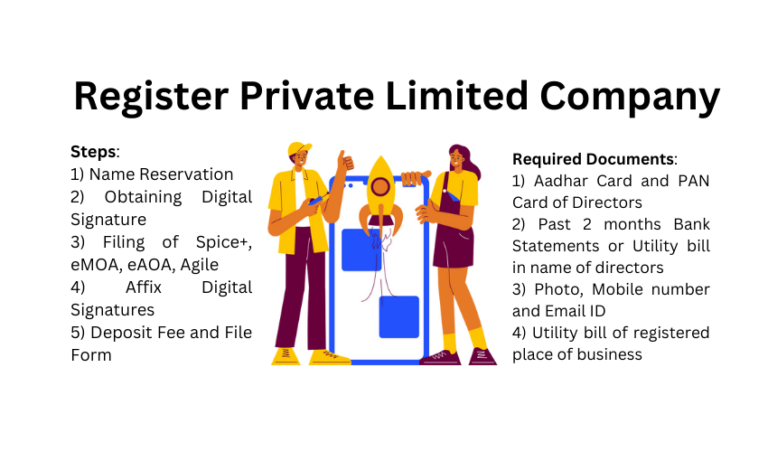

Register Private Limited Company in India online. Private Limited Company Registration is one of the first steps of starting your own company and business in India. Private Limited Company do not only...

When starting a business in India, one of the initial steps involves registering your company. A crucial part of this process is getting your company name approved. The approval of your company name...

In a recent decision, the Income Tax Appellate Tribunal (ITAT) Jaipur disposed of the appeal filed by Shri Ladu Ram, an agriculturist from a rural area, against the impugned order passed by the...

CA Bhuvnesh Goyal Partner CA Bhuvnesh Goyal is a Chartered Accountant with expertise in taxation, finance, and business compliance. He shares practical insights to help readers navigate complex...

Delhi, January 24, 2025:The Income Tax Appellate Tribunal (ITAT), Delhi Bench, delivered a significant ruling in favor of Jindal Saw Ltd. (formerly Saw Pipes Ltd.) regarding the taxability of excise...

Date of Pronouncement: 02.01.2024Bench: Income Tax Appellate Tribunal (ITAT), Delhi The Income Tax Appellate Tribunal (ITAT) Delhi Bench dismissed the ITAT appeal filed by the Revenue...

Income Tax Calculator Income Tax Calculator Total Annual Income (₹): Deductions under Section 80C (₹): LIC Premium: PPF (Public Provident Fund): NSC (National Savings Certificate): ELSS (Equity Linked...

The Union Budget is one of the most anticipated events in India’s fiscal calendar, and it plays a crucial role in shaping the nation’s economy. This page will provide all the essential details you...

ByCA Bhuvnesh Goyal

August 13, 2024

Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015

Applicability of certain provisions of Income-tax Act and of Chapter V of Wealth-tax Act The provisions of Chapter XV of the Income-tax Act relating to liability in special cases and of section 189...