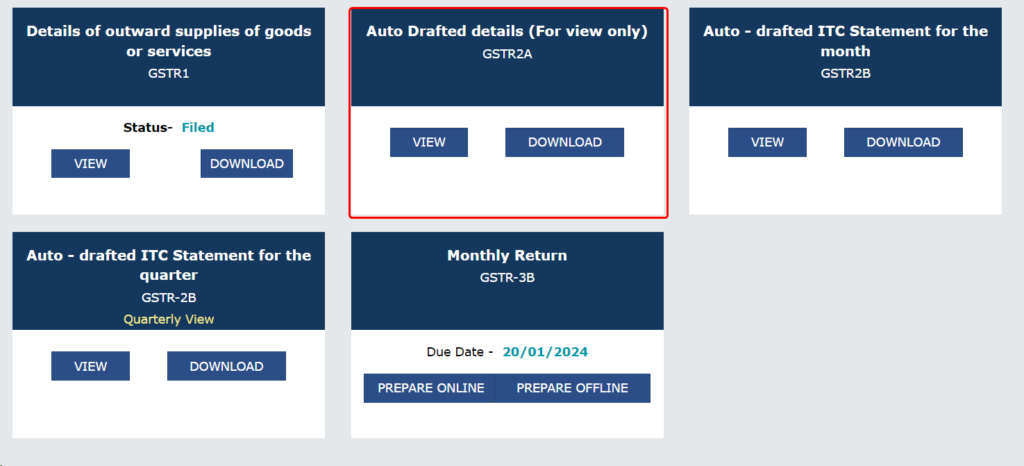

GSTR 2A Return

The Goods and Services Tax has eased the process of indirect taxation considerably since its introduction in India in 2017. However, despite the relative simplification in regards to the previous tax regime, it’s still in the nascent stages. Hence, there is still some degree of blurriness concerning its functioning among the business community in India. […]