Sundry creditors is a term used to describe individuals or businesses that provide goods or services on a credit basis. A business that makes use of this facility and takes goods or services from another business on credit, will refer to the provider of these goods or services as sundry creditors.

The concept of sundry creditors is made up of two words; ‘sundry’ and ‘creditor’. In order to understand the term itself, it is important to know the meaning of both these words. The term ‘sundry’ is used to describe a variety of items that need not be mentioned individually.

Another term often used to describe ‘sundry’ is – miscellaneous. The word creditor is used to describe an organization or an individual who is involved in providing ‘credit’ to another organization or individual. The word ‘credit’ here is used to illustrate the fact that the agreed-upon price is not paid right away, rather the product is sold on a credit basis, which means it is sold on the assumption of payment in the future.

What are Sundry Creditors?

Sundry creditors are businesses or individuals who provide different services or goods on credit terms. They are also considered to be such individuals or companies to whom a certain business owes their money since the credit facility was availed against certain services or goods.

Within a company, sundry creditors act as a liability since they owe a certain amount to another business due to a transaction. A credit payment timeline is agreed upon between two parties – the one that offers the goods or services and the company that is availing credit facility against goods or services supplied.

Sundry Creditor Example

In order to gain a deeper understanding of what sundry creditors actually means, let’s take the help of an example. In this scenario, we will consider two parties; Sha Enterprises and Pat Pipes. Sha Enterprises is a real estate developer and the buyer in this case, whereas Pat Pipes is a pipe manufacturer and is the seller in this case.

- Sha Enterprises places an order with Patel Pipes for buying pipes worth Rs 50,000 and the date of this purchase is 1st March 2023.

- Pat Pipes has dealt with Sha Enterprises a lot in the past and conducts ongoing business with them, hence extends them a line of credit frequently.

- Due to their trust-based relationship, Pat Pipes gives Sha Enterprises 2 months of credit period.

- This means that the payment from Shah Enterprises is now due on 1st May 2023.

- Sha Enterprises will record this transaction under sundry creditors and the entire amount due will be considered as an account payable.

This sundry creditors example is a simple one, to outline how a basic sundry credit transaction may occur. Another important topic surrounding this subject is accounts payable; let’s find out what it means in the next section.

Sundry Creditors Ledger Account Format

Creditors, classified as liabilities, maintain a positive credit balance within the accounts. Whenever credit purchases are conducted throughout a fiscal year, they are recorded as credits in creditors’ accounts, thus contributing to an augmentation of creditors’ balance.

Conversely, any transactions that diminish the creditors’ balance, such as payments to creditors or purchase returns, are recorded as debits.

The format for ledger accounts related to sundry creditors is as follows –

Sundry Creditors A/C

| Dr. | Cr. | ||||

| Date | Particulars | Amount (Rs) | Date | Particulars | Amount (Rs) |

| To bank A/C | *** | By Balance b/d (opening sundry creditors balance) | *** | ||

| To Purchase Return A/C | *** | By Credit Purchases A/C | *** | ||

| To Bills Payable A/C | *** | *** | |||

To Balance C/D (closing balance of sundry creditors) | *** | *** | |||

| ***** | ***** | ||||

FAQs

How to Record Sundry Creditors?

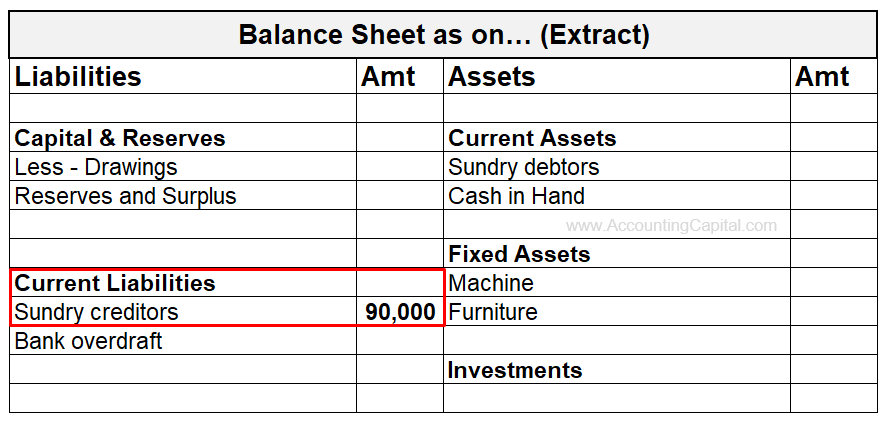

sundry creditors in your business as a liability. It appears on the credit side of the balance sheet of the company. However, certain companies opt to use a separate category of account called sundry creditors account or accounts payable account to track any payments made against such transactions.

Sundry Creditors is Which Type of Account?

Sundry creditors, also known as accounts payable, fall under the liability account of a business. This is mainly because businesses supply services or goods in advance to other companies or individuals, and the payment is received later. The buyers tend to pay money to the seller later, and sundry creditors become the liability of the business. Thus, they are recorded under the ‘liabilities’ head of the balance sheet.