Ordinarily it takes about 4 to 5 weeks for the refund to be deposited into your account. If not, then make sure you have checked your emails for any intimation received from the Income Tax Department or a Refund Banker (SBI) that the processing of your income tax refund

An income tax refund is sanctioned when a taxpayer pay more duties than their actual liability. It can be issued against different types of direct taxes, like self-assessment tax, Tax Deducted at Source, foreign tax credit, advance tax, etc.

IT refund is calculated after filing an income tax return. If a taxpayer is eligible to get a refund, he or she is informed of the same via an SMS or email. It contains the total amount of refund credited to one’s account, along with a refund sequence number, in accordance with Section 143(1) of the Income Tax Act, 1961.

The fund is credited either directly to the taxpayer’s account via RTGS or NEFT or is sent via cheque or demand draft to the registered address. has failed, you can submit a ‘Refund Reissue Request’ by logging into the Income Tax e-filing portal Taxpayer can raise the service request in e-filing portal through the ‘Refund Reissue Request’ service.

What is Income Tax Refund?

A refund occurs when a taxpayer files the tax return with a tax liability which is less than the taxes paid. The Income Tax Department issues a refund, which is credited to the bank account mentioned while filing the Income Tax Return or a cheque is sent to the mailing address.

Refund Banker Scheme

The Refund Banker Scheme is operational for taxpayers assessed all over India (except at Large Taxpayer Units) and for returns processed at CPC (Centralized Processing Centre). In the Refund Banker Scheme, the refunds generated on the processing of Income-tax Returns by the Assessing officers/CPC-Bangalore are transmitted to State Bank of India, CMP branch, Mumbai (Refund Banker) on the next day of processing for further distribution to taxpayers.

Failure for Income Tax Refund

A refund from the income tax department scheduled to be paid in a particular assessment year (AY) may fail to get credited to your bank account for various reasons. A few of the reasons for the failure of the refund to get credited to your account could be:

- In case the bank account is not pre-validated. It is now compulsory to pre-validate your bank account from the assessment year (AY) 2023-24

- The name mentioned in the bank account does not match with PAN card details. For example, in case your bank account was opened providing the Aadhaar card as proof, there is a possibility that it mentions your middle name as well, while on the PAN card, such detail is not stated

- In case of an invalid IFSC code. For example, a bank might have undergone a merger and there has been a change in the IFSC code, but you have failed to update the same.

- There is also a possibility that the account that you have mentioned has been closed

- The Account is not linked with PAN or PAN is not linked with Aadhaar.

Modes of Issuing Refunds

The assessee who files their Income-tax Return online gets their refund cheque issued by Centralized Processing Centre (CPC) of Income Tax Department at Bangalore. Refunds are being sent to the assessee in the following two modes:

- RTGS / NECS: The refund amount will be credited to the assessee’s bank account if he has given the correct bank account details in Income tax Return Filed by him.

- Paper Cheque: Income Tax Refund Cheque would be sent to the assessee if he failed to give correct bank account details in Income tax Return Filed by him.

How to Make a Refund Reissue Request Online?

1. Log in to the Income Tax Portal:

- Visit the official Income Tax Department e-filing portal: incometax.gov.in.

- Log in using your user ID (PAN/Aadhaar) and password.

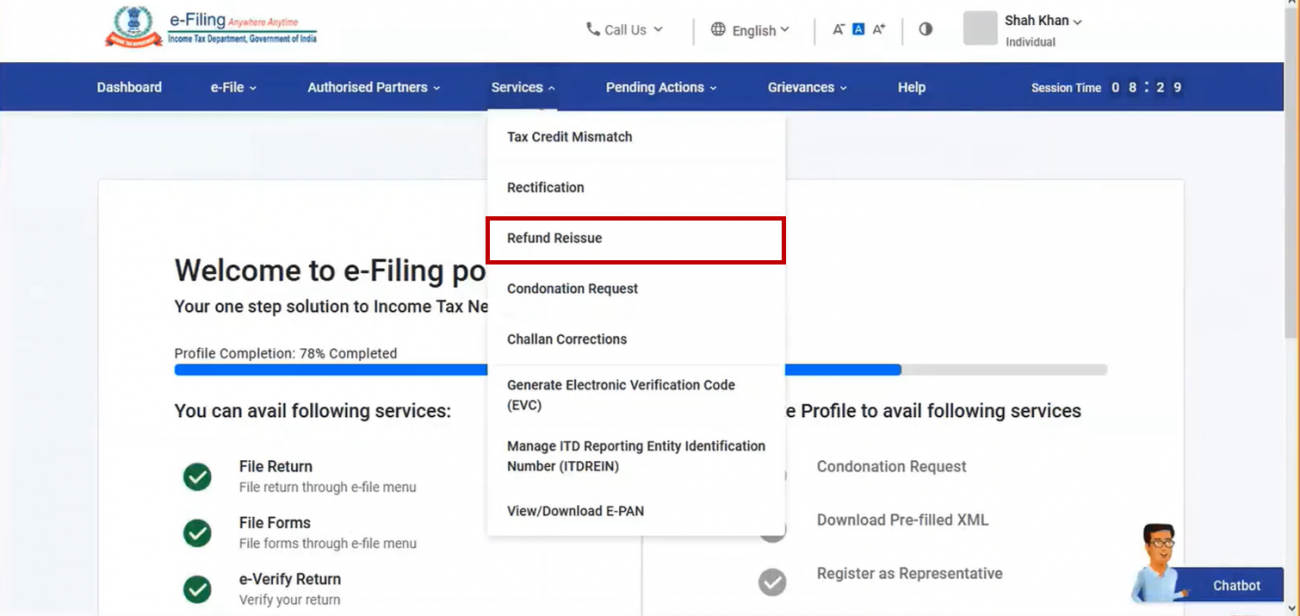

2. Navigate to the Refund Reissue Request:

- After logging in, go to the Services tab, then to Refund Reissue Request:

- Choose the relevant assessment year for which the refund reissue is required.

3. Submit the Request:

- You will provided with a list of refunds pending for different AYs

- Click on the Refund Re-issue button on the card

- Click on Create New Request to proceed further

4. Verify Your Request:

- Select the bank account to which refund is to be credited. Only bank account details validated in income tax portal will be shown here

- If you do not see any bank accounts, goto profile > bank account > validate them

5. A success message will be displayed confirming the refund reissue request submission.

FAQs

Is the income tax refund taxable?

No, the income tax refund amount is not taxable, however, the interest received on the tax refund stands taxable according to the applicable tax slab rate.

What is the difference between an income tax return and income tax refund?

The income tax return is the income tax details that you provide annually to the Income Tax Department. The income tax refund, on the other hand, is the amount you would receive in case of excess payment of income tax.