House Rent Allowance (HRA) is an allowance (part of CTC) given by your employer to help you cover the cost of living in a rented accommodation. However, due to a lack of experience or understanding of how the salary structure works, many are not fully aware of how to utilize this allowance.

No Income Tax on Annual Income Up to ₹12.75 Lakh!

The government has raised the Section 87A rebate limit from ₹7 lakh to ₹12 lakh, providing major tax relief to the middle class. Salaried individuals can also claim a ₹75,000 standard deduction, making incomes up to ₹12.75 lakh tax-free.

New Slab Structure under new tax regime:

- ₹0 – ₹4 lakh → No Tax

- ₹4 lakh – ₹8 lakh → 5%

- ₹8 lakh – ₹12 lakh → 10%

- ₹12 lakh – ₹16 lakh → 15%

- ₹16 lakh – ₹20 lakh → 20%

- ₹20 lakh – ₹24 lakh → 25%

- ₹24 lakh & above → 30%

Extended time for filing updated returns (ITR-U):

Taxpayers now get 4 years (instead of 2) to update their Income Tax Returns.

These changes will be effective from 1 April 2025 i.e. for FY 2025-26

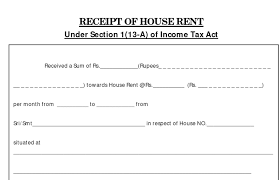

Rent Receipt

A rent receipt is a document that proves the payment of rental for the property by a tenant to the landlord. In India, employers are required to have proof before allowing HRA exemption. Hence, rent receipts are requested by employers to allow exemption on HRA. Further, if the annual rent paid a tenant is more than Rs. 1 lakh, it is mandatory to obtain PAN of the landlord and report it to the employer to claim HRA exemption.

Why is It Required?

A rent receipt is a document provided by a landlord to a tenant acknowledging the payment of rent. It typically includes details such as the amount paid, the date of payment, the duration covered by the payment (e.g., month or week), the name of the tenant, and the signature or stamp of the landlord or property manager. Rent receipts serve as proof of payment and are important for both landlords and tenants to maintain accurate financial records.

To claim a House rent allowance (HRA), it is necessary to provide evidence of the payment of the rent to the employer; rent receipts work as evidence. The employer can provide deductions and allowances after verifying the same. The HRA allowance is based on the rent receipts and will be calculated accordingly.

Benefit of Rent Receipts

- Proof of Income: Rent receipts serve as an official record of rental income received. This is crucial when reporting income for tax filing, especially if you’re a landlord.

- Tax Deductions for Tenants: For tenants, rent receipts are necessary for claiming deductions under Section 80GG of the Income Tax Act, which offers tax benefits for rent paid.

- Legal Protection: In case of disputes with the tenant or landlord, rent receipts act as legal evidence of payment, helping to avoid conflicts.

- Record Keeping: Rent receipts help maintain proper records of transactions, making it easier for both parties to track payments over time.

- Property Valuation: Rent receipts can also help in establishing the market value of a property, useful for capital gains tax calculations if the property is sold in the future.

- Loan Eligibility: If you’re applying for a loan, having a consistent record of rental income through rent receipts can help demonstrate financial stability to lenders.

What is the format of Rent Receipt?

The transaction of rent happens between tenant & landlord on a certain date each month for a premise having an address and rent of xxx amount for the period of a month

So, for each rent receipt to be valid, the following mandatory elements must be present in a rent receipt:

- Tenant Name (If you are the tenant, fill in your name)

- Landlord Name

- Amount of Payment

- Date of Payment and mode of payment

- Rental Period

- House Address (Rented Property)

- Signature of Landlord or Manager

- Signature of Tenant

Other elements that are part of rent receipts:

PAN of the Landlord(not mandatory; mention only if annual rent exceeds Rs.1,00,000 in a year)

Revenue Stamp(where an amount exceeding Rs. 5000 is paid in cash)

- Method of payment (cash, credit card, money order, cashier’s check)

- Services or other fees included in the payment (e.g., utilities, security deposits, convenience fees

Key Information on rent receipts

- Landlord’s contact information.

- Tenant’s name.

- Total amount paid.

- Rental property location.

- Rental period covered.

- Payment method.

- Date payment received.

FAQs

What is the Tax Benefit of Paying a Rent?

Salaried professionals paying rent can avail of an HRA exemption, thus can save on taxes. They can claim exemption on HRA as per Section 10 (13A) of the IT Act. The deduction you can claim is the minimum of:

- Actual HRA received

- 50% of salary if you live in a Metro city

- 40% of salary if you live in any other city

- The actual rent you pay minus 10% of your annual salary

- Self-employed professionals can avail of tax deductions under Section 80GG against rent paid.

Penalty for Fake Rent Receipts?

The penalty for submitting fake rent receipts can vary depending on the jurisdiction and the severity of the offense. Civil Penalties: This could involve being sued by the landlord or property management company for damages, including the unpaid rent or any financial losses incurred due to the fraudulent activity.

- Criminal Charges: Falsifying documents, including rent receipts, may be considered a criminal offense. If convicted, the individual could face fines, probation, community service, or even imprisonment depending on the severity of the fraud and local laws.

- Tax Penalties: If the fake receipts are used to claim deductions on taxes, the individual may face penalties from tax authorities, including fines and interest on unpaid taxes.

- Reputation Damage: Being caught submitting fake rent receipts can damage a person’s reputation, particularly if it involves a professional setting or business transaction. This could impact future rental opportunities, employment prospects, or relationships with financial institutions.