File Income Tax Return (ITR) in Jaipur with CA Bhuvnesh Goyal

Contact details for Income Tax Return (ITR) Filing in Jaipur

Emailil: support@cabkgoyal.com

Mobile: 9971782649

Income Tax Return Filing in Jaipur- Our Services

Income Tax Returns in Jaipur Rajasthan are filed under section 139(1) of Income Tax Act, 1961. It is the charging section of Income Tax in India. Income Tax in Jaipur are to be paid on incomes earned from 5 sources i.e Salary, House Property, Capital Gains, Business and/or profession and Other sources.

Salaried Income Tax Return Filing

Income Tax Return Filings, Preparation of tax computations, multiple employer filing in the same year; Analysis of 26AS, annual informations statement, form 16, salary slips and bank statements

Income Tax Return in case of Sale of Property

Income Tax Return Filings, Preparation of tax computations, Calculation of Capital Gains, Determining the cost of acquisiition, cost of improvement, indexation; Analysis of sale deed, agreement to sale, stamp duty value, stamp duty paid, forfeiture

Income Tax Return for FD Interest

Income Tax Return Filings, calculation of correct FD Interest; Analysis of 26AS, annual informations statement, FD Interest Certificates and bank statements

Share trading ITR Filing

Income Tax Return Filings, Calculations of profit/loss, turnover and purchases

Business ITR Filing

Income Tax Return Filings, Preparation of Profit & Loss Accounts and Balance Sheets. Filings under section 44AD, ITR 3 and Income Tax Audits

Pension Income Tax Return Filing

Income Tax Return Filings, Preparation of tax computations, multiple employer filing in the same year; Analysis of 26AS, annual informations statement, form 16, pension slips and bank statements

NRI Income Tax Return

Income Tax Return Filings, Determination of residential status, Determination of taxable Income, Determination of Non Taxable Income

Income Tax Return for rental incomes

Income Tax Return Filings for rentals earned on house property, calculations of interest on loan taken for house property

F&O Trades ITR Filing

Income Tax Return Filings, Understanding the transactions of F&O, Income Tax Audits (in case turnover exceeds the prescibed limits)

Companies Income Tax Return

Filings of Income Tax Returns for Companies registered under Companies Act. Preparation of computation of tax liability, filing of Profit and Loss Account, Balance Sheet

Can you file Income Tax Return in Jaipur your self without the help of a Chartered Accountant ?

The answer to this question is a big Yes. So, first lets see how you can do it without the help of anybody including by simply going to the website of Income Tax Departement and then we will answer the real question i.e should you file your Income Tax Return in Jaipur on your own without the help of a Chartered Accountant or in what cases the return can be filed on your own. Lets first see the simple steps of filing the Income Tax Return in Jaipur on your own:

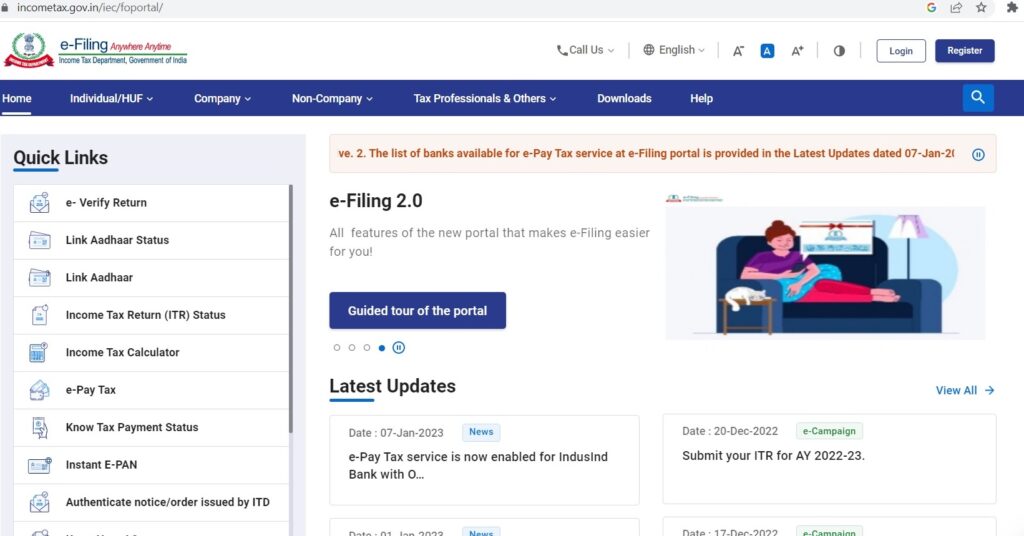

Step 1: Go to the Government website by clicking here or using the the following URL https://www.incometax.gov.in/iec/foportal

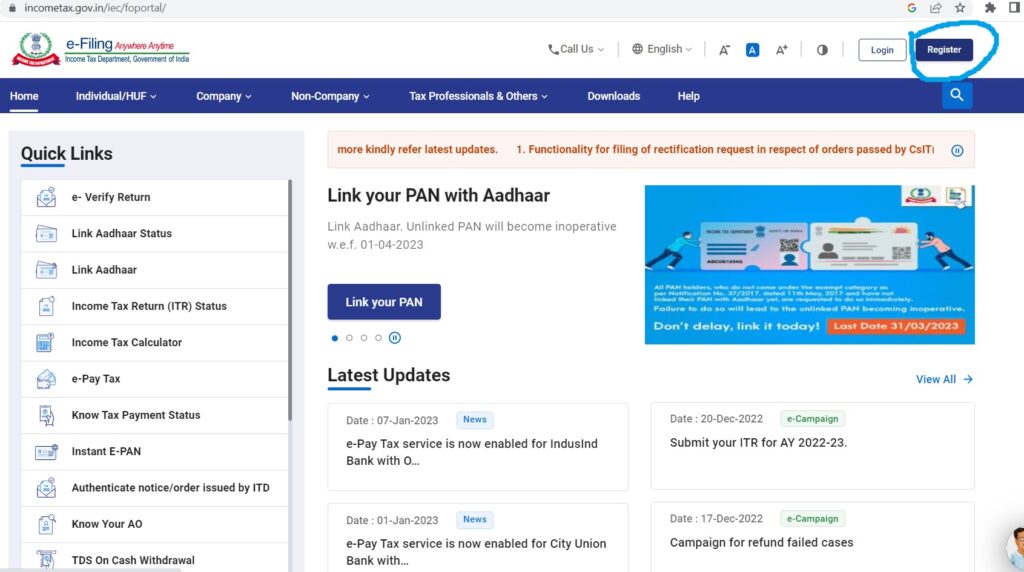

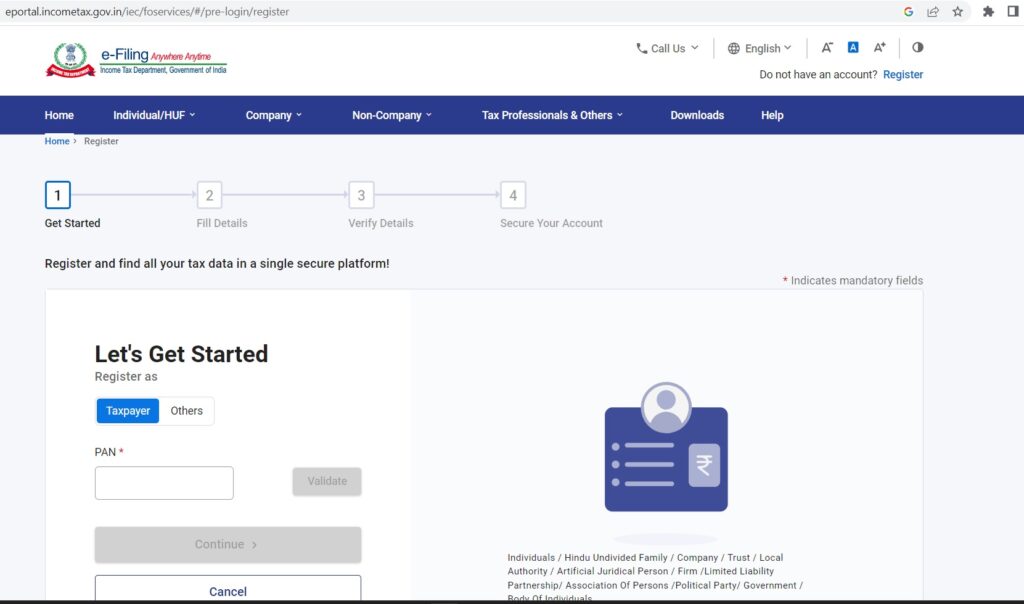

Step 2: The second step is to register yourself on the Income Tax Portal. If you are already registered then proceed to step 3. If you are not registered then make sure you have a VALID PAN Number with you, if you do not have a PAN Card then you can simply have one using Instant PAN facility by going to the Government website Link by clicking here or using the following URL https://eportal.incometax.gov.in/iec/foservices/#/pre-login/instant-e-pan. Once you have a VALID PAN with you, proceed as follows:

Click on register which is availiable on the right top corner (Fig 2) then enter your PAN number (Fig 3) and continue. You will be required to fill in the details such as your address, mobile number and email ID. You are also will be asked to create password. Once you fill in the details, OTP will be sent on both email and mobile number. On entering the OTP, the account on Income Tax Portal gets created, Congratulations, you can now move on to step number 3 !!

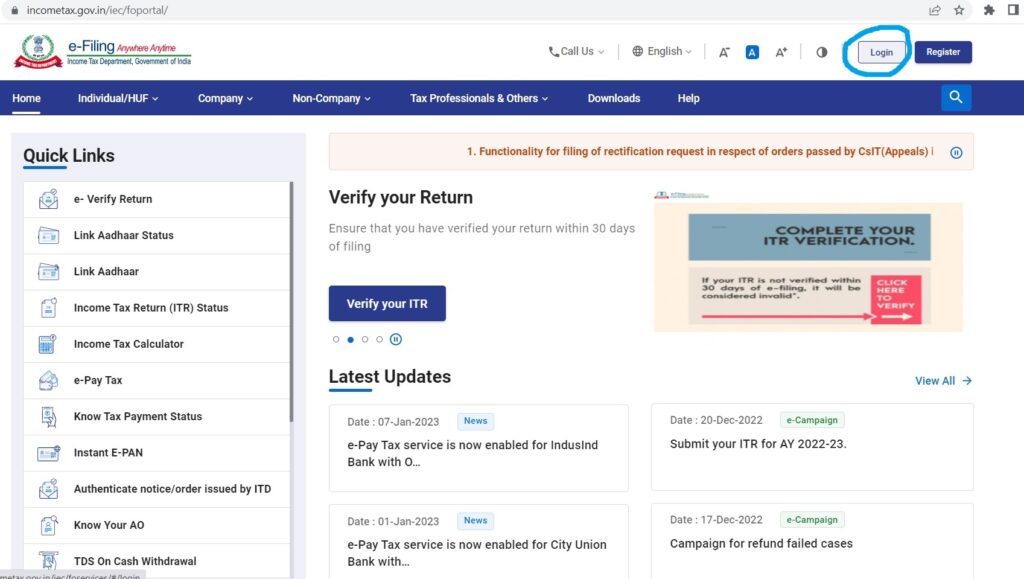

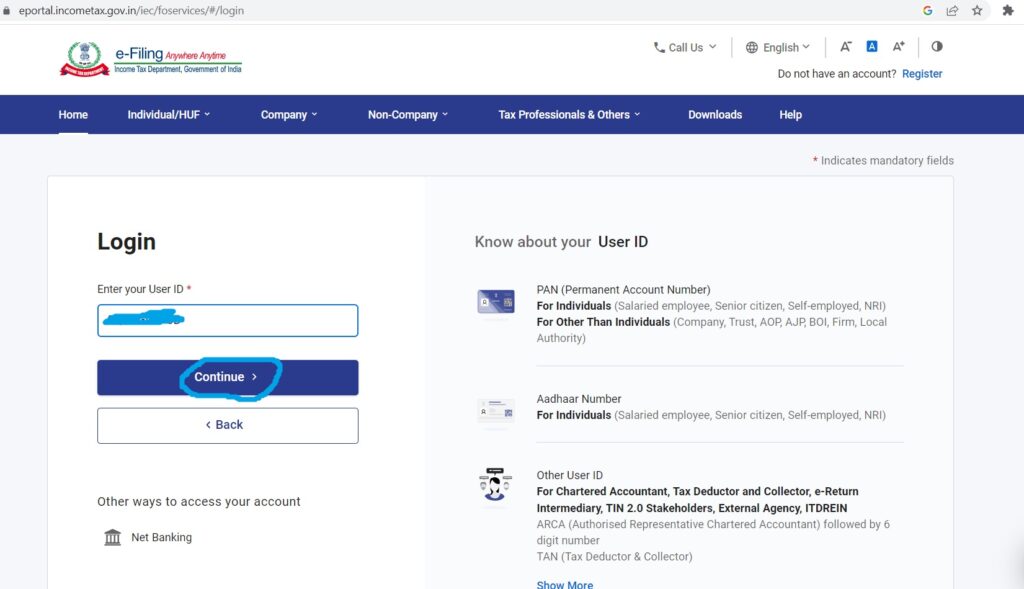

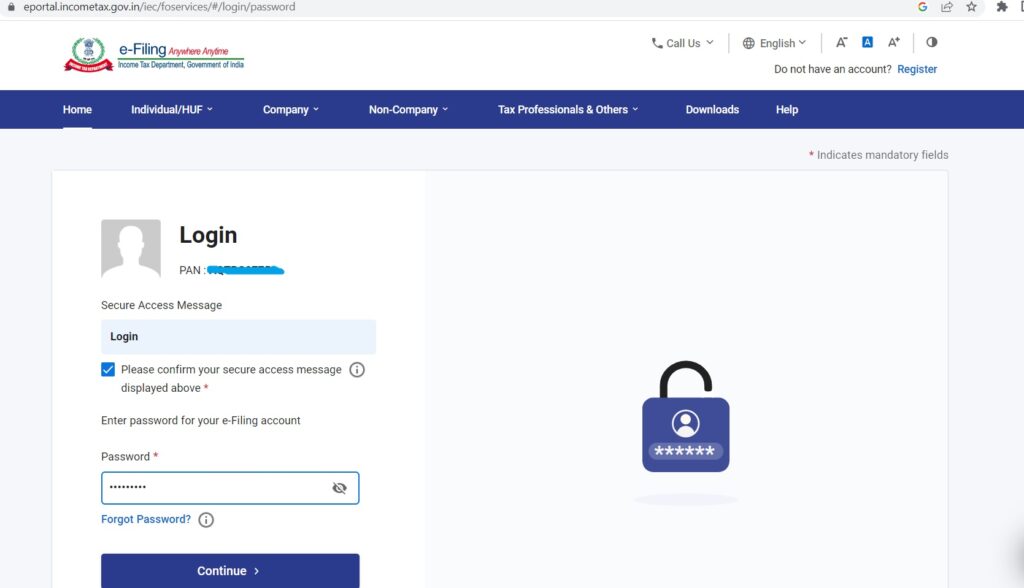

Step 3: Once you are registered, go to the Government website again clicking here or using the the following URL https://www.incometax.gov.in/iec/foportal and click on Login at the right top corner. You will be required to enter your PAN Card as your user ID and Password which you created in step 2 to proceed further. (note: In case you do not remember your password or you cant recall if you have already registered on the portal or not then you can simply enter your PAN and click forgot password as well. The password can easily be reset through Aadhar otp or otp received on registered email & mobile). So how did we proceed in this step ?

Click on login (fig 4) – Then enter your PAN number and Click on Continue (Fig 5) – Then check the box which says please confirm your secure access message displayed above, enter password and click on continue (Fig 6) to move forward to step 4.

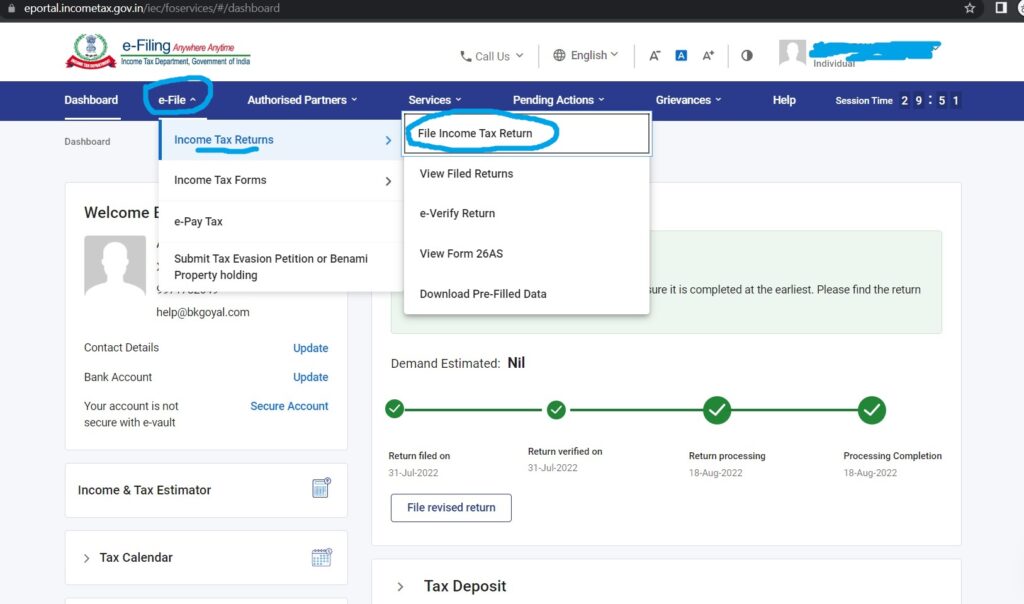

Step 4: After you are logged in – Take your cursor to e-file tab – then on Income Tax Returns and then click on File Income Tax Return (fig 7)

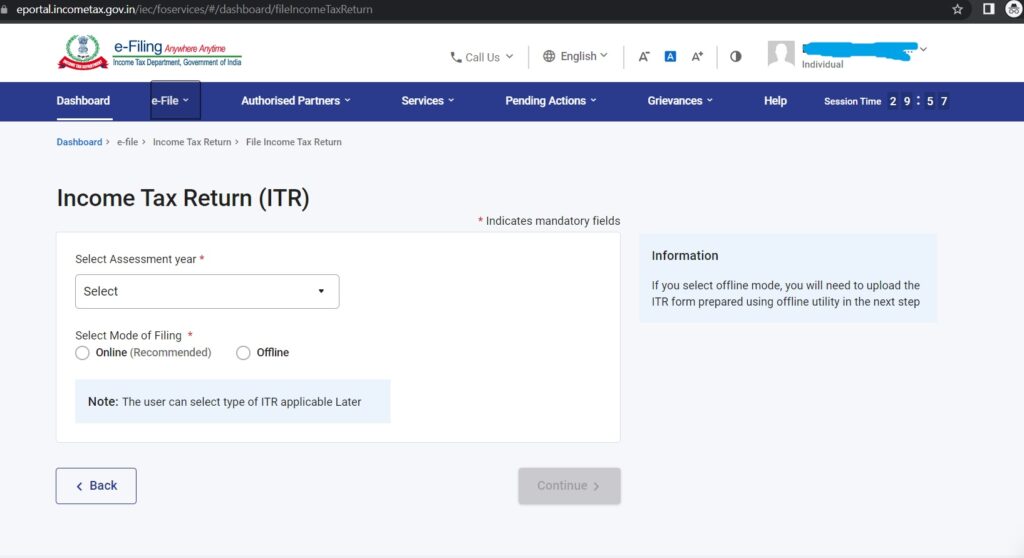

Step 5: Select the Assessement Year for which ITR needs to be filed, Select the filing type i.e Original Return, Revised Return, Belated, Updated Return and check on yes or no on the question are you audited u/s 44AB or political party as per section 13A as the case may be > Select the mode of filing i.e Online or Offline (Online mode is recommended for self filing as Offline mode is usually done through softwares) and click continue (fig 8) > and Start new filing

Step 6: Selection of Status > Choose ITR Form to be filed (i.e ITR 1 or 2 or 3 etc)

Step 7: Some information will be prefilled already on the basis of TDS statements, 26 AS and Annual Information Statement and some income information is to be filled (it is advisable to avoid answering to the questions and straight forward proceed to fill in the Income details for better filing experience)

Step 8: Once all the information and income detail is filled, verify the information with form 26 AS, Annual Information Statement, your salary slips, Form 16, bank statements, GST Returns (if any) as well to cross check everything and file the return.

Step 9: Once the return is filed in Jaipur, it is needed to be verified which can be done through an otp within the statutory time limit

Congratulations, the ITR is Filed in Jaipur. Lets now explore the real question i.e should you file your Income Tax return on your own without the help of a Chartered Accountant ?

Lets understand the different source of Incomes under Income Tax Act For Filing ITR in Jaipur -

- Income under head Salary: Every Salaried Employee having salary more than Rs 2.5 Lakhs are required to file their Income tax return. Income Tax return can also be filed if salary is less than Rs 2.5 Lakhs

- Income under head house property: House property or flat given on rent attracts Income Tax under head house property which is to be disclosed in the Income Tax Return and relevent Income Tax to be paid.

- Income under head capital gain: Capital gain arises on transfer of any asset such as House, Land, Machinery, Vehicle etc. The transfer of asset would be liable to tax on the gains made on such transfer.

- Income under head business and/or profession: Business includes means an activity which leads to provision of any Goods and Service including Manufacturing, Trading, Services such as IT, Tourism etc

- Income under head other sources: Interest earned on Fixed Deposits, Savings Accounts, Loans advances are to be shown in Income Tax Return along with other sources of Income if any.

Process of efiling Income Tax Return in Jaipur with B K Goyal & Co LLP Chartered Accountants and CA Bhuvnesh Goyal?

Step 1: Email the pictures of your PAN Card, Aadhar Card (both side), Mobile Number and Email ID to help@bkgoyal.com

Step 2: Email all your Income Details such as Form 16, Salary slips, FD Interest Certificates, Share trading P&L Statements, House loan interest certificates to help@bkgoyal.com

Step 3: Creation of Income Tax Profile/Resetting Password through Aadhar otp by B K Goyal & Co LLP Chartered Accountants

Step 4: Analysis of all the documents, reconciliation of all the details with 26AS, Annual Information Statement, Form 16, Capital Gain Reports, Salary Slips, GST Returns and creation of initial draft of Computation of Income by us.

Step 5: Submission of additional documents as may be required by B K Goyal & Co LLP Chartered Accountants for further filings through email

Step 6: Prepration of draft computation and sharing the same over email to you for your feedback

Step 7: Telephonic Conversation with CA Bhuvnesh Goyal for further discussion on draft computation of Income and discussion for better tax planning & reportin of Income for litigation free assessement.

Step 8: Final draft of computation will be prepared and shared over email for its acceptance from your side along with details of fee to be deposited, amount of eligible refund/additional tax to be deposited.

Step 9: Once the acceptance of draft and fee is received, we will proceed with the filing procedure for you.

Step 10: Once the Income Tax Return is filed for Assessement year 2023-24, we will e-verify it through Aadhar otp (In case additional tax needs to be deposited, then we will need to deposit the additional tax first in order to file Income Tax Return)

Step 11: Once the ITR is e-verified, we will email the Final Computation of Income and Income Tax Return along with Tax Challan Receipt (if any)

Note: Once the entire process is complete, Income Tax return will be sent to CPC(Bangalore) for Processing. An intimation will be received by you under section 143. The intimation is the final product of the entire process which informs you the actual amount of refund/additional amount of tax still need to be paid.

We keep on checking for any Income Tax Notices, Demands raised by CPC Bangalore or Assessing Officer for any of the year including all the past years as well to minimise the future litigations.