The high-low method is ultimately used to identify incurred costs that change from one period to the next and other costs that occur at the same time and rate each period. It compares the highest and lowest levels of activity associated with the total cost for each period.

What Is the High-Low Method?

In cost accounting, the high-low method is a way of attempting to separate out fixed and variable costs given a limited amount of data. The high-low method involves taking the highest level of activity and the lowest level of activity and comparing the total costs at each level.

If the variable cost is a fixed charge per unit and fixed costs remain the same, it is possible to determine the fixed and variable costs by solving the system of equations. It is worth being cautious when using the high-low method, however, as it can yield more or less accurate results depending on the distribution of values between the highest and lowest dollar amounts or quantities.

How do people use the high-low method?

You can use the high-low method to compare costs at their highest and lowest levels with the total cost it requires to produce a good, service or other product. People use the high-low method along with other metrics to organize costs within their business. Some financial analysts use this metric to determine the rates at which a stock portfolio might change. Besides comparing the costs of goods at the highest and lowest levels of production, you can also use the high-low method to predict the total cost of goods for a future production period.For example, if you analyze a two-month production period where you produced 20 goods and 25 goods, respectively, with their associated costs, you can predict what it costs to produce 30 goods in the next month. This can help you decide whether the amount of work you aim to complete is worth the cost of production for that month.

What are the formulas for the high-low method?

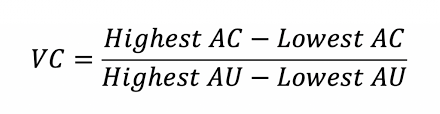

There are three formulas you can use to calculate the high-low method effectively. The formulas are as follows:

Variable cost per unit = (Highest activity cost – Lowest activity cost) / (Number of highest activity units – Number of lowest activity units)

Total fixed cost = Highest activity cost – (Variable cost x Number of highest activity units)

Total cost per unit = Total fixed cost + Total variable cost

Limitations of the High-Low Method

The high-low method is relatively unreliable because it only takes two extreme activity levels into consideration. The high or low points used for the calculation may not be representative of the costs normally incurred at those volume levels due to outlier costs that are higher or lower than would normally be incurred. In this case, the high-low method will produce inaccurate results.

The high-low method is generally not preferred, as it can yield an incorrect understanding of the data if there are changes in variable- or fixed-cost rates over time or if a tiered pricing system is employed. In most real-world cases, it should be possible to obtain more information so the variable and fixed costs can be determined directly. Thus, the high-low method should only be used when it is not possible to obtain actual billing data.

FAQs

How Is the High-Low Method Used?

The high-low method is used to calculate the variable and fixed costs of a product or entity with mixed costs. It considers the total dollars of the mixed costs at the highest volume of activity and the total dollars of the mixed costs at the lowest volume of activity.

Why Is the High-Low Method a Simple Analysis?

Because it takes less calculation work. The high-low method only requires the high and low points of the data and can be worked through with a calculator.