The Code on Wages, 2019 is a law that consolidates and simplifies four previous wage-related laws in India. It aims to ensure fair wages and timely payments to workers while reducing compliance burdens for businesses.

What is the Code on Wages, 2019?

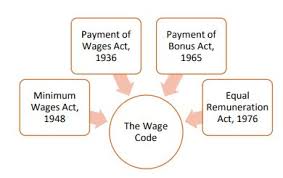

The Code on Wages, 2019, was passed by Parliament in August 2019 and seeks to streamline wage-related laws. It replaces the following laws:

- Payment of Wages Act, 1936

- Minimum Wages Act, 1948

- Payment of Bonus Act, 1965

- Equal Remuneration Act, 1976

Applicability of Code on Wages, 2019

Employees in both the organised and unorganised sectors will be covered by the Code. Wage payment provisions in the Code will apply to all employees, regardless of wage ceiling or type of employment, whereas the Payment of Wages Act, 1936 was only applicable to factories, certain specified establishments, and employees drawing monthly wages of up to INR 24,000, and the Minimum Wages Act, 1948 was only applicable to scheduled employments.

The Central Government will make wage-related choices for employment in the railway, mining, and oil fields, among other sectors, under this Code, while the State Government would make decisions for all other sectors. The term of ’employee’ now includes contractors, ensuring that even contractors are eligible to be paid the Code’s minimum wage.

Employees vs. Workers under Code on Wages, 2019

The Code establishes two distinct meanings of ’employees’ and ‘workers’. Individuals in supervisory, managerial, and administrative roles are included in the definition of ’employee,’ whereas individuals employed in a supervisory capacity drawing a monthly salary exceeding INR 15,000 are excluded, while sales promotion employees and working journalists are specifically included. Because the definition of employee is broad, it implies that such categories of employees will also be covered by the Wage Code, in contrast to the Minimum Wages Act, 1948, which defined ’employee’ as any person employed for hire or reward to do any work, skilled or unskilled, manual or clerical, in scheduled employment for which minimum rates of wages have been fixed.

However, there are contradictions between the remuneration of ’employees’ and ‘workers’ under the Code. For example, under Section 6(6) of the Code, only “workers” and not “employees” are specified for determining minimum pay rates

The Worker under Code on Wages, 2019

Any worker who does skilled, semi-skilled, unskilled, manual, operational, supervisory, management, administrative, technical, or clerical labour in any business.

Exclusions: Apprentices and personnel of the military forces are not included.

Working journalists and “sale promotion employees” both fall within the definition of “anyone hired in any sector for pay or reward to conduct any manual, unskilled, technical, operational, clerical or managerial labour.” For the purposes of an Industrial Dispute, the individual who was fired, released, retrenched, or otherwise terminated, or who suffered as a result of the above, is the one who initiated the conflict.

Gender discrimination in salaries and recruitment of employees for the same or comparable job is forbidden under the Code, except when the employment of women in such work settings is prohibited/restricted by law. ‘Work of comparable kind’ is described as ‘work for which the expertise, effort, experience, and responsibility required are the same’.

The Employer under Code on Wages, 2019

In addition to the regular definition of a person who employs employees in its establishments, the Code has expanded the definition of ’employer’ to include an occupier or manager of a factory, a person with ultimate control over the company’s affairs, a managing director, contractor, and legal representative of a deceased employer.

The current legislation either did not include such a description or only specified it in regard to factories and institutions where authorities had ultimate authority. This was insufficient, resulting in uncertainty when defining the character of an employer.

Wage under Code on Wages, 2019

Trying to improve the Minimum Wage

Employers are prohibited under the Code from paying wages less than the authorised minimum wage. The Central and State Governments will announce the minimum wage. These minimal salaries must take into consideration workers’ talents, geographical locations, hours of work or piece of work, arduousness of labour such as temperature, humidity, dangerous vocations or procedures, and so on. The Code applies equitably to all employees in an organisation.

The minimum wage will be amended and evaluated every five years by the Central or State Governments.

The new concept of “floor wages” is established by this Code. According to the Code, the Central Government would establish a baseline pay based on workers’ living conditions as well as geographical locations. The competent government (central or state) can set the minimum wage rate based on the floor pay rate. The applicable government’s minimum wage cannot be less than the floor pay. If the present minimum wages set by the relevant government are greater than the floor wage, they cannot be reduced.

Payment of Wages

A new wage payment provision has been added, allowing salaries to be paid in current coin, currency notes, by check, by crediting the earnings to the employee’s bank account, or by electronic means.

The salary term is currently fixed by the employer under the Code as daily, weekly, fortnightly, or monthly, to guarantee that it does not exceed one month.

Wage payment deadlines have also been established. If an employee is removed, fired, retrenched, resigns, or becomes jobless as a result of an establishment’s closure, his or her pay must be reimbursed within two working days of such removal, retrenchment, or resignation.

This definition now includes the term “resignation,” which is a crucial issue for the employer to remember.

The number of hours that constitute a typical working day may be determined by the relevant authorities. Employees who work more than eight hours in a typical working day are entitled to overtime pay, which must be at least twice the regular rate of pay.

Under the Code, an employee’s wages may be withheld for a variety of reasons, including:

- Penalties;

- Leave of absence;

- Employer-provided accommodation; or

- Repayment of advances made to the employee, among other things.

These deductions are limited to 50% of the employee’s total salary. If the deductions exceed 50%, the excess can be recovered under the criteria outlined in the Wage Code. If the employer’s deductions are not deposited with the trust or in a Government fund, the employee cannot be held liable for the employer’s failure to do so.

Key Provisions of the Code

1. Uniform Definition of Wages

- The Code provides a standard definition of “wages” applicable across all aspects, reducing disputes.

- It includes basic pay, dearness allowance, and retaining allowance but excludes certain allowances like bonuses and pension contributions.

2. Minimum Wages for All

- Unlike the earlier law, which applied only to specific sectors, minimum wages now apply to all workers, including unorganized sector employees.

- The government will fix minimum wages based on skills, difficulty of work, and geographical location.

3. Timely Payment of Wages

- Employers must pay wages monthly, weekly, or daily, depending on the employment type.

- Wages must be paid before the 7th day of the next month for establishments with fewer than 1,000 workers and before the 10th day for others.

4. Gender Equality in Wages

- The Code ensures equal pay for equal work for men and women.

- Discrimination in recruitment and employment based on gender is prohibited.

5. Bonus Payments

- Employees earning below a specific wage threshold are entitled to a minimum bonus of 8.33% of their salary or ₹100, whichever is higher.

- The maximum bonus is 20% of wages.

6. Single Authority for Wage Disputes

- The law simplifies dispute resolution by appointing one authority instead of multiple bodies.

- A time-bound grievance redressal mechanism is established.

7. Digital Payments Encouraged

- Employers are encouraged to pay wages through digital modes, ensuring transparency.

FAQs

Key definitions under the code on wages?

| Terms | Definition |

| Establishment | Includes any place where any industry, business, trade, occupation, or manufacturing is run. This also includes government organisations. |

| Employer | Any person with ultimate control over the work that goes on within any establishment, It can also include delegated authorities in the form of managers or managing directors who have been asked to oversee the operations within the establishment. |

| Employee | Any person employed by an employer for salary to do skilled, semi-skilled, unskilled, manual, operational, supervisory, managerial, administrative, technical or clerical work. Exclusions: Does not include apprentices, or members of the armed forces. |

| Workers | Any person employed in any industry to do skilled, semi-skilled, unskilled, manual, operational, supervisory, managerial, administrative, technical or clerical work. Exclusions: Does not include apprentices, or members of the armed forces. |

| Contractors | Any person who takes up a job with any establishment, to deliver expected or given results. It also includes sub-contractors. |

Penalties for Non-Compliance?

- When an employer provides a lower salary to an employee

If an employer pays an employee less than the amount owing to such employee, the employer may be fined up to Rs. 50,000/- (Section 54 (1)(a)). - Recurrence of offence covered by section 54(1)(a))

If the same violation under section 54 (1)(a) is committed again within 5 years, the employer faces imprisonment for up to 3 months, a fine of up to Rs. 100,000/-, or both. (Section-54(1) (b)) - When the Employer violates any other provisions/rules/orders

If an employer violates any other provisions/rules/orders, he may be fined up to Rs. 20,000/- (Section 54 (1) (c)). - Failure to maintain or improperly maintaining records

If records are not maintained or are not kept properly at the establishment, the employer may be fined up to Rs. 10,000/- (Section 54(2)). - Officers’ Appointment and Penalty Imposition

The competent government should select an official not lower than the rank of Under Secretary to the Government of India/State to impose penalties in specific situations specified by sections 54(1)(a), (c), (2), and Section 56 (7), Section-53. - Company Law Violations

If a company commits an infraction under this code, any person who was in control of and accountable to the company for the conduct of the company’s business at the time the crime was committed, as well as the company, will be judged guilty of the offence and will be penalised (Section-55). - Combination of offences

Any offence committed under this law, excluding those punished by imprisonment alone or imprisonment and fine must be compounded by a Gazetted Officer designated by the competent government for an amount equal to half the maximum fine authorised for such offence (Section 56). - Cognizance of Offence

The court will take notice of an offence under this code based on a complaint submitted by the appropriate government/authorized officer/employee/registered trade union/inspector-cum-facilitator. The Metropolitan Magistrate/Judicial Magistrate First Class will hear cases under this code (Section 52).