Register Private Limited Company in India online. Private Limited Company Registration is one of the first steps of starting your own company and business in India. Private Limited Company do not only offers limited liability, separate legal entity but provides credibility to a business and gives them an opportunity to raise funds in the form of equity from the investors.

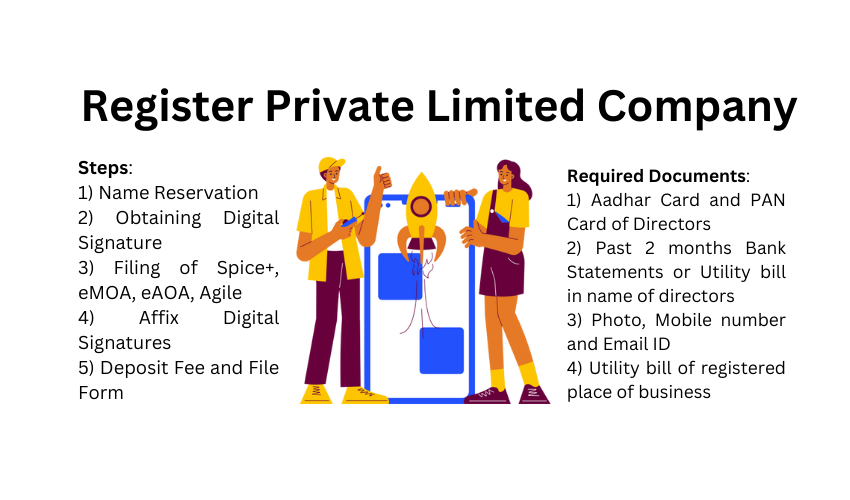

Documents Required to Register Private Limited Company

The following documents of minimum to proposed directors are required for Private Limited Company Registration:

- Identity Proof: PAN Card and Aadhar Card.

- Address Proof: Past 2 months bank statement or Utility bills in their name.

- Photographs: Passport-sized photographs.

- Proof of Registered Office: Utility bill (Electricity bill or Water Bill or Phone Bill) as proof of the office address.

In case, a proposed director is a foreign national, currently living outside India then his/her passport and a local id of her country duly apostilled will be required.

Process to Register Private Limited Company

The registration process of Private Limited Company is completely online in India, all forms and applications are filed online on the MCA website. The following are the steps to register private limited company:

- Name Reservation: The first step is the application for name reservation of the company.

- Application for Digital Signatures of the proposed directors

- Filing of forms online on MCA website including eMOA, eAOA, SPICE+, and AGILE

- Download the filed forms and affix the signatures of the proposed directors

- The forms are now required to be attested either by a practicing Chartered Accountant or a Practicing Company Secretary.

- Uploading the signed forms to the Government website and submitting them along with deposit of Government fee.

- Filing of replies with corrections in case the forms are sent for clarification by the Government.

- Approval of applications from Government and issuance of Company Incorporation Certificate, PAN Card, and TAN Card.

Know more on Registration of Private Limited Company in India

Our team of CA in Jaipur and CA in Delhi, will be happy help with any queries related to Private Limited Company Registration in India. Feel free to write or connect for any query.