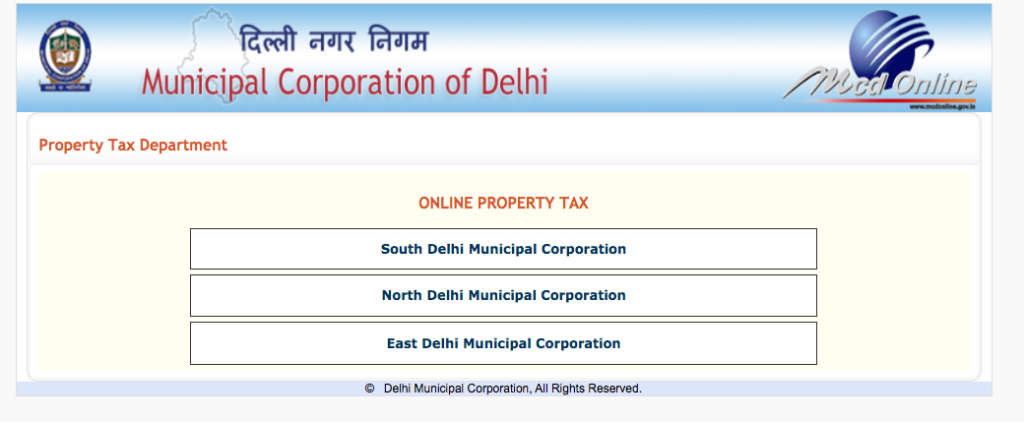

Delhi Property Tax

SDMC stands for the South Delhi Municipal Corporation, which is a government entity that is responsible for the infrastructural development of South Delhi. Therefore, every property owner of the city is mandated to pay the SDMC property tax to contribute to their community’s upliftment. Property tax is a vital source of revenue for any state […]