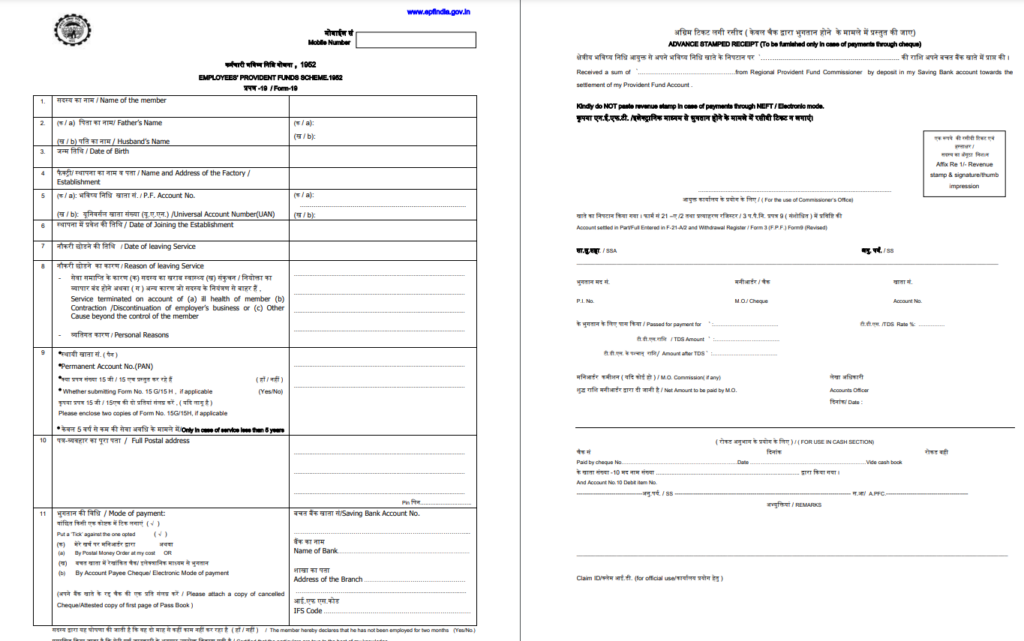

PF Claim Form 19

Employees’ Provident Funds and Miscellaneous Provisions Act 1952, an employee has to make a specific contribution of remuneration to the provident fund account, and an equal contribution has to be made by an employer. Withdrawals under this scheme require an EPFO member to fill up a handful of forms, PF Form 19 being one of them. What […]