ITR U: A Complete Guide to Filing an Updated Return

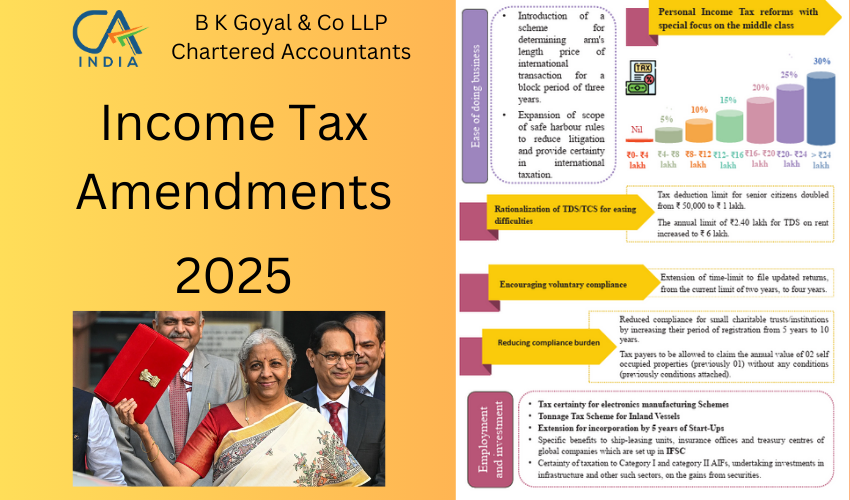

What is ITR U? ITR U is a form introduced by the Income Tax Department of India that allows taxpayers to file an Updated Return. If you made a mistake in your original tax return or forgot to report some income, you can correct it using ITR U. This form was introduced under Section 139(8A) of […]